Bank aggregation: the solution that simplifies your financial management

imene-lechkhab-marketing

•

Oct 24, 2024

Today, nearly half of consumers in France are multi-banked. Whether it's our account at a traditional bank like Caisse d’Épargne or Crédit Agricole, that of a 100% online bank like BousoBank, and our PayPal account... The proliferation of payment channels has accelerated in the last ten years, due to the digitization of our consumption habits.

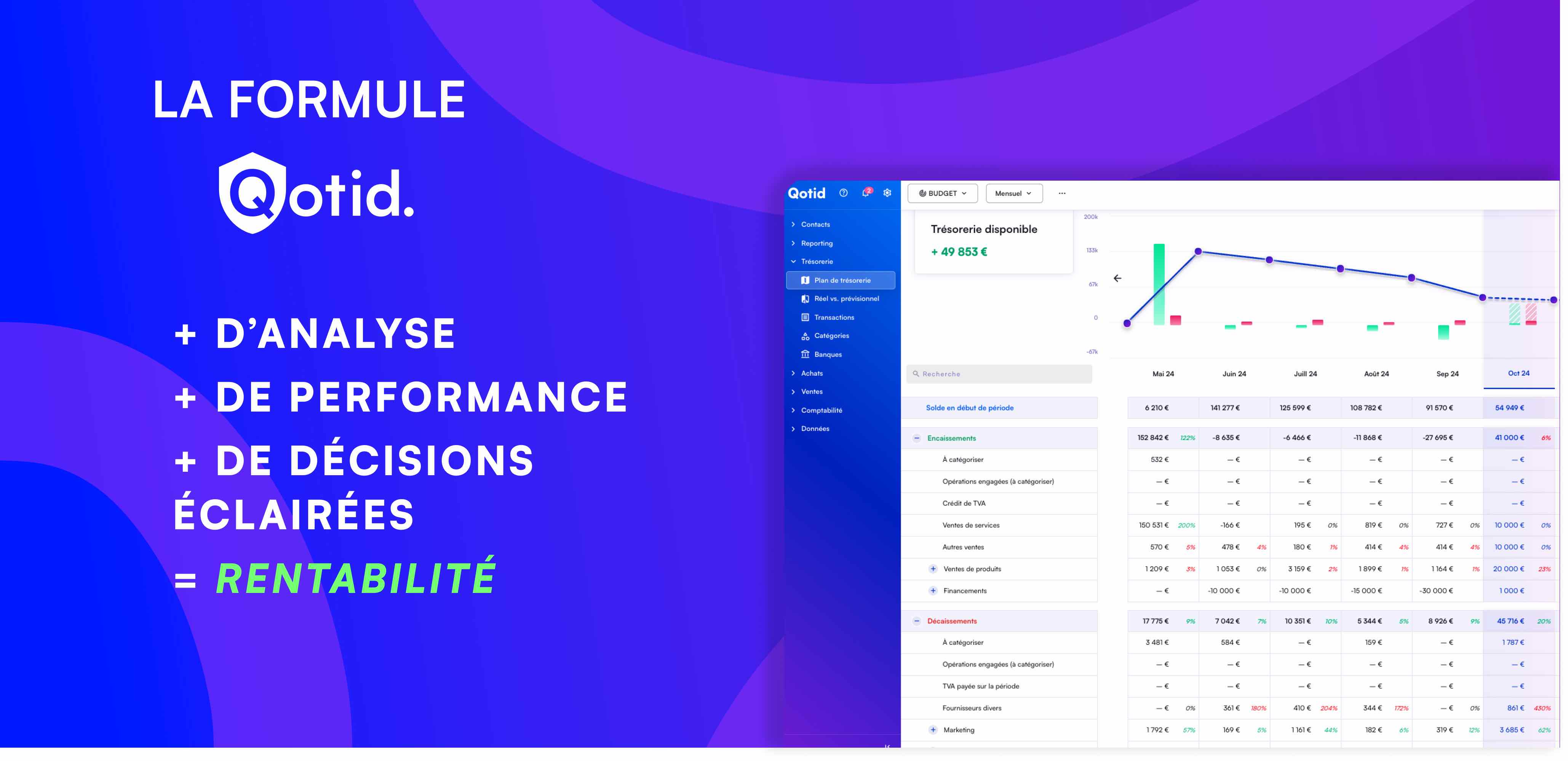

Businesses are much more affected by multi-banking, making it essential to aggregate their various accounts into a single interface. Why? For better visibility of their finances and informed, enlightened decision-making!

Fortunately, Fintech companies have rapidly developed to meet this growing need and offer increasingly advanced multi-banking management options.

What is bank aggregation?

Bank aggregation involves consolidating data from multiple bank accounts within a single interface. With an aggregation solution, it becomes possible to access all your financial flows at a glance, thus facilitating better visibility of the company's finances.

With the rise of open banking, established by the PSD2 (the European directive on payment services) which came into effect in 2018, the APIs of banks now allow financial management software like Qotid to offer an overview of your finances without having to log in to each bank separately.

The concept is similar to bank transfers but benefits from additional security: that of your approval via your device and authentication (biometric, FaceID, password...).

Who can be a bank account aggregator?

Bank aggregators are software or applications from Fintech, i.e., companies specialized in financial management. Banks also offer bank aggregation services to meet the growing demand related to the multi-banking of their clients.

However, to be a bank aggregator, one must ensure maximum protection of clients' bank data. This service can only be provided if the company is certified by PSD2 and has been approved by the ACPR, the Prudential Control and Resolution Authority. These strict regulations around open banking establish security in the transfer and sharing of bank data via an API.

What is the PSD2?

PSD2 (the Second Payment Services Directive), introduced in 2018, establishes regulations around online payments. It is notably responsible for enhanced security through strong authentication: hence the online purchases that redirect you to your bank's app and ask you to authenticate through multiple steps! Although these steps during the purchase can be tedious, they are necessary for the security of your bank data.

But this need for security is not limited to online payments, as it also applies when using a bank aggregator. PSD2 also imposes formal conditions on applications or bank account aggregation interfaces. Thus, it allows you to have a comprehensive view of your various bank accounts without having to worry about the security of your bank data. Indeed, this data is encrypted thanks to highly secure solutions like Powens and Bridge.

What is an API in bank aggregation?

Widely used by financial management software, the API (application programming interface) is a kind of tunnel that allows data exchange between two interfaces. Take the example of Qotid, which has nearly 76 integrations via API. Each of these integrations allows sharing information with other software or platforms: whether it’s your accounting data with Pennylane, Sage, or your PMS hotel, all your invoices are retrieved from these platforms to our software. You will then benefit from a comprehensive view of your deadlines without having to transfer everything manually.

What are the benefits of bank aggregation?

Bank aggregation offers numerous advantages to businesses and individuals:

Centralization of bank accounts: Access all your accounts through a single platform.

Simplified payments: Track your payments in real-time, without having to switch between multiple banking interfaces.

Increased visibility: At a glance, gain a complete view of your business finances, which facilitates decision-making and cash management.

Time savings: Automating banking tracking tasks allows for more time to be devoted to higher-value tasks.

Features of bank aggregators

Real-time synchronization of data from multiple banks

Real-time synchronization is one of the key features of a good bank aggregator. It allows to collect and display instantly all transactions made on the various bank accounts associated with a business.

Using APIs (in accordance with the PSD2 directive), the aggregator can obtain a continuous stream of financial data, thus avoiding delays in information. This guarantees immediate and accurate visibility on the company's cash flow, essential for quick and informed decision-making.

Compatibility with many financial institutions

A good aggregator must be able to connect to a wide range of banks and financial institutions, whether they are traditional banks or neo-banks such as Boursobank.

The aggregator's ability to synchronize with multiple institutions is crucial to meet the needs of businesses in the era of multi-banking.

This compatibility offers maximum flexibility to businesses that work with different banking providers, while consolidating financial data in a single centralized dashboard. In addition to banks, cash management software is multiplying integrations and also allows you to automatically transfer accounting data (quotes, invoices) and pay multiple invoices with one click.

Categorize transactions, set category rules and create your own cash flow categories

Transaction categorization is another pillar of effective bank aggregators. This feature allows for organizing cash inflows and outflows based on predefined categories (salaries, suppliers, overheads, etc.), while giving the option to set custom rules.

For example, a company can choose to automatically categorize all invoices from a supplier under a specific category. Similarly, if the application has this functionality, it can carry out accounting matching.

This facilitates expense analysis, improves budget management, and allows for quick identification of trends or anomalies. Adding custom categories is particularly useful for businesses with specific needs or unique industry sectors.

Visualize cash outflows, inflows and cash balance

Visibility of cash outflows (outgoing payments), cash inflows (incoming income), and the cash balance is crucial for any business.

An effective aggregator must allow visualization of these elements simply and graphically, in real-time through a dashboard, which helps anticipate periods of financial strain or to take advantage of liquidity surpluses to invest.

This instant view of financial flows also helps detect discrepancies between forecasts and actual movements, enabling proactive adjustments to financial strategies.

Also read: The best cash management software

Budget forecasts

Budget forecasts represent an advanced but essential feature for proactive management of business finances.

A good banking aggregator must be capable of forecasting future cash flows based on past transactions, recurring payments, and information available on future inflows and outflows.

These forecasts are essential for planning liquidity needs, identifying periods when the business might face cash shortages, and implementing adjustment strategies (such as negotiating payment terms or seeking financing). The budgeting forecast feature also helps compare actual results with the company's financial objectives.

Visualize deadlines to quickly address payment delays

Meeting payment deadlines is crucial for maintaining good business relationships and avoiding financial penalties.

Your banking aggregator should allow you to monitor upcoming deadlines, both for payments to be made and for expected inflows. By quickly identifying payment delays, the company can take necessary measures to avoid cash incidents or late fees. This feature also contributes to an optimized management of receivables and payables, ensuring that the company honors its financial commitments while avoiding leaving money on the table.

These features are essential for any business looking to improve its financial management. They allow for optimizing the tracking of financial flows, preventing liquidity issues, and making informed decisions based on up-to-date data in real-time.

Who is involved in bank account aggregation?

This certainly involves essential needs for businesses such as SMEs and large groups. If it's a multi-site business like a restaurant or hotel chain, then it is absolutely essential to use a bank account aggregator with advanced features.

For individuals, a Square study reveals that 42% of banking customers are multi-banked. Certainly, the number of users of online banks in addition to a traditional bank is increasing, especially in the 18 - 35 age group. This is a trend that is becoming more common with the digitization of payments. Well-known bank aggregators like Bankin' are very useful for promoting general financial education.

Regarding freelancers or self-employed individuals, although they have to juggle between their personal and professional bank accounts, their needs remain quite limited. This depends, of course, on the potential of the business project.

If you are starting with a large production chain (textile industry, multi-site restaurant and hotel, etc.), having financial planning functionality is a very good choice.

FAQ

1. Can I initiate payments from the aggregator?

Some bank aggregators have payment features, especially financial management software. For an SME or large company, it can be very interesting to initiate payments from the aggregator to streamline transactions. With software like that of Qotid, you can pay multiple invoices with one click and visualize your payment deadlines thanks to the aged balance feature. You will no longer have to worry about forgetfulness or delays in payments.

2. How is bank data protected?

Since 2018, open banking is subject to the security standards of the PSD2, using strong authentication mechanisms and secure APIs to protect your data.

3. How does a bank aggregator's API work?

The API allows you to connect to banks or other management software and access your information securely, providing you with an overview of your finances.

4. Can I also aggregate my investments (wealth, stock market investments, crypto…)?

Yes, there are specialized applications for bank aggregation like Finary, which allow you to aggregate your real estate investments, your assets, and even cryptocurrencies.