Supplier account management: what are the impacts on cash flow?

Amber Baynaud

•

Oct 18, 2024

Managing the accounts payable and optimizing cash flow are two very closely related topics. Today, the goal of all businesses is to ensure their financial health. But what does that mean?

The financial health of a business is reflected in its cash flow, that is to say, in the amount of all the liquid assets immediately available to it, which allows it to meet its financial obligations. Optimizing this cash flow requires a relevant and precise global management.

The overall management of a company relies on managing different areas. In this article, we will focus on managing accounts payable. This represents how an organization will manage its relationships with its suppliers. It is an essential component in the process of optimizing the company's value chain, and it will therefore strongly influence the state of its final cash flow.

What is the role of accounts payable?

Accounts payable play a real strategic role in the sustainability of a business.

What is accounts payable?

It is much more than just a list of creditors and primarily represents a process that includes contracts with suppliers, payment terms, and debts to be paid. Accounts payable correspond to the way the company manages its relationships with all its business partners on which it relies, whether for its raw materials, products, or services. When this management is effective, the fluidity of the supply chain is guaranteed: goods are delivered, and payments are settled, which avoids potential disputes.

Accounts payable consist of various elements. We can identify the number and diversity of suppliers, payment terms, negotiations, supplier debts, inventory volume, and working capital.

What are the stakes of accounts payable?

Accounts payable represent many challenges for businesses that they must face to ensure sufficient cash flow.

Negotiation with suppliers

The commercial relationship between a company and its suppliers is accompanied by a bond of trust. Delivering goods means receiving payment in return, although this is not immediate and depends on the established payment terms.

The capping of these payment terms is set by the commercial code.

Unless agreed otherwise between the parties, the payment term is set at 30 days from the date of receipt of the goods or execution of the service.

The term agreed between the parties cannot exceed 60 days from the invoice issuance date.

By exception, a maximum term of 5 days at the end of the month from the invoice issuance date may be agreed upon by a contract between the parties.

In case of periodic invoicing, the agreed term cannot exceed 45 days from the invoice issuance date.

Many companies tend to negotiate longer payment terms with their suppliers to optimize their final cash flow. The goal is to collect receivables from clients before settling supplier debts. This method, although widely used, has some drawbacks. First, there could be a potential deterioration of the relationship that the company has with its suppliers, which may stem from repeated and abusive negotiations or from non-compliance with set deadlines. Furthermore, this method can lead to the company being unable to have a clear view of its real cash flow.

However, while this method of deferring payment terms to suppliers may have its downsides, don’t hesitate to implement it when faced with cash flow issues, and when you’re uncertain if you will be able to meet your debts. This way, you can stagger your payments carefully, without taking risks with your cash flow.

Mastering negotiations with suppliers, which include payment terms, is therefore essential for a company. This guarantees a reliable representation of real cash flow and evidently preserves commercial goodwill.

Working capital

Working capital is a financial indicator that informs about the company's ability to meet its long-term obligations without resorting to borrowing. Its measurement reflects the financial health of the company and assesses whether it will be able to support its operations and invest in the future.

Working capital can be calculated in three different ways:

The first relies on the upper part of the balance sheet:

Working capital = Permanent capital - Fixed assets

The second relies on the lower part of the balance sheet

Working capital = Current assets - Short-term debts

The third is slightly more detailed:

Working capital = Stable resources from the upper part of the balance sheet (capital, profit, debts + provisions for charges) - Gross fixed assets

These different calculations will lead to three possible interpretations depending on the result obtained.

Working capital is greater than 0. This means that the company is in good financial health: its long-term investments and current expenses are covered by resources.

Working capital is equal to 0. This means that the company has enough resources to finance its long-term investments, but not enough to finance its current expenses.

Working capital is less than 0. This means that the company does not have enough resources to finance its investments: it is financing its fixed assets through short-term debts, which jeopardizes future financing of its current expenses.

Good management of accounts payable will benefit the company’s financial resources. This will positively impact the result of its working capital, which could even contribute to a positive working capital, and thus to the solvency of the company.

Inventory volume

Having a sufficient inventory volume means that the company is able to deliver the product or execute the service immediately. This also indicates good cash flow: a company that experiences poor inventory management may find itself overstocked, which can incur additional costs.

Effective management of accounts payable requires good inventory management: a company must be able to meet its customers’ demands. It is necessary for it to anticipate demand and adjust its supplies closely to avoid both overstocking and stockouts. It is thus crucial to monitor the inventory turnover of each of its products.

Moreover, storing merchandise generally costs the company as working capital is directly impacted.

To ensure inventory management and a sufficient volume of stock to meet demand, it is essential for a company to establish regular stock monitoring.

Why is managing accounts payable important for the financial health of the company?

The way a company manages its relationships with its suppliers will have immediate consequences on its overall performance. When relationships with partners are well managed, this often translates into good communication, consistent quality in the delivered products or services performed, increased reactivity to market fluctuations, opportunities for negotiation, or even advantageous payment terms.

On the other hand, when management is not rigorous, this can lead to stockouts, unexpected additional costs due to emergency orders, for example, or even a deterioration of the company's reputation.

For these various reasons, managing accounts payable is important and can, in addition to ensuring financial and operational stability, become a source of performance that elevates the company towards success.

Supplier debts: their impact on cash flow

What is a supplier debt?

Supplier debts correspond to the obligation for a company to pay its suppliers. It is the outstanding balance on a contract established between a company and a supplier, which presents the amount for a number of products or services that remain unpaid. The company will receive an invoice on which this amount will appear, which it will be obliged to pay within a timeframe previously agreed upon with the supplier. Suppliers may grant various payment terms to companies, giving them a bit more time to have sufficient funds to make this disbursement. All these contracted debts will be grouped under liabilities in the financial statements.

Supplier debts are often used to finance the company and represent an important financial resource (due to the fact that they have not yet been disbursed).

It is important to always monitor the evolution of these supplier debts to avoid significant mismatches with cash flow. This monitoring would result in decisions relating to payment due dates, for example, in order to optimize cash flow effectively.

Their impact on cash flow

As we have mentioned, supplier debts influence the company's cash flow and represent a significant financial resource. Nowadays, many companies seek to lengthen their payment terms to have this financial resource available for as long as possible.

High supplier debts can translate into both a high level of trust from business partners towards the company in question and a decrease in the need for working capital.

Optimize the working capital with accounts payable management

What is the working capital requirement?

The working capital requirement (or WCR) is an indicator that represents a company's short-term financing needs. It is the necessary amount for businesses to cover their current expenses while awaiting payment from their clients.

The WCR reflects the financial autonomy of the company: if a company can finance its charges before receiving payment from its clients, it is financially autonomous.

There are two formulas for calculating the WCR: a simplified and an extended one.

Simplified formula

Working capital requirement = Receivables + Inventories - Debts (all non-financial debts)

Extended formula

Working capital requirement = Operating uses - Operating resources

We can interpret three possible results:

The WCR is positive: Operating uses exceed operating resources. This means that the company has a financing need for some of its uses. It will have to finance them through its working capital or through its financial debts.

The WCR is zero: Operating uses are covered by operating resources. The company has no financing need but does not have any financial surplus.

The WCR is negative: Operating uses are entirely covered by operating resources. The company has no financial need and will even generate a surplus that will increase the net cash flow balance.

Also read: What is a cash requirement?

How could accounts payable management optimize the WCR?

Most of the time, when a company experiences a positive WCR, it is when its established payment terms with suppliers are shorter than its payment terms with clients: it has to disburse money that it has not yet received.

In the opposite situation, when the WCR is negative, it is said that companies have resources in working capital. This means that the payment terms with suppliers are longer than those with clients. This is often the case in the retail sector, where clients pay upfront.

To optimize the WCR, it is possible to better manage accounts payable. For example, it is possible to:

Negotiate payment terms with suppliers. This would give the company sufficient margin to generate value before making any payment.

Avoid prepayments as much as possible.

Select suppliers with the shortest delivery times. It is important that the company’s activity can continue and intensify to generate maximum value while waiting to pay suppliers.

Optimize order placements: ensure that not all orders are placed simultaneously to avoid being overwhelmed with supplier invoices.

Not to anticipate the suppliers' payments to obtain discounts.

The working capital requirement can be significantly optimized through good accounts payable management within the company, the objective always being to ensure the company’s financial health in the short, medium, and long term.

The risks of ineffective accounts payable management

Ineffective accounts payable management exposes the company to multiple risks that can be financial, strategic, or even operational.

Payment delays

One of the risks arising from ineffective accounts payable management is delayed payments. Delays that are repeatedly prolonged or for too long can impact both suppliers and the company.

The risk for suppliers, especially for small businesses that do not have sufficient financial resources, is to become financially paralyzed due to the non-recovery of their invoices by companies.

For companies, payment delays can incur significant financial penalties that could directly affect their profitability. Failing to reimburse supplier debts on time can negatively influence strategic decision-making that would not be based on the right figures. This can also impact relationships with suppliers and the supply of products and services. If payment delays involve raw materials, for example, suppliers may decide to terminate the business relationship, which would have an immediate consequence on the company’s supply.

Damaged reputation and business relationships

Errors in invoice processing, frequent delays, or communication problems may arise due to poor commercial management. The company’s reputation may be adversely affected, which will impact not only existing relationships with business partners but also the company’s ability to negotiate favorable terms with new suppliers.

Fragile cash flow

Unpredictable, poorly planned, or repeatedly late payments can lead to the company’s cash flow being fragile. As a result, investment forecasts or management of operational costs are compromised and lead to significant budget imbalances. This financial instability could ultimately jeopardize the company’s viability in the long term.

Disputes and fraud

Ineffective accounts payable management can lead to disputes or fraud. For example, when a company accounts for all its supplier debts, it may also account for debts coming from fraudulent suppliers. These debts would then be recorded just like the others, which could be costly for the company.

Moreover, if these supplier debts are not well managed, some debts could become unpaid or paid twice, which could lead to expensive legal conflicts within the company and with suppliers.

Working capital requirement

Finally, the working capital requirement could increase due to ineffective accounts payable management. Payment delays that are too long for supplier debts may lead to an excess of supplier debts on the balance sheet compared to client receivables or inventory, which would tend to increase the WCR.

Thus, there are multiple risks associated with ineffective accounts payable management. These risks have immediate consequences in the long, medium, and short term and could directly impact the company’s cash flow. To remedy this, optimizing and promoting efficient and proactive accounts payable management, numerous financial management solutions provide support to business leaders.

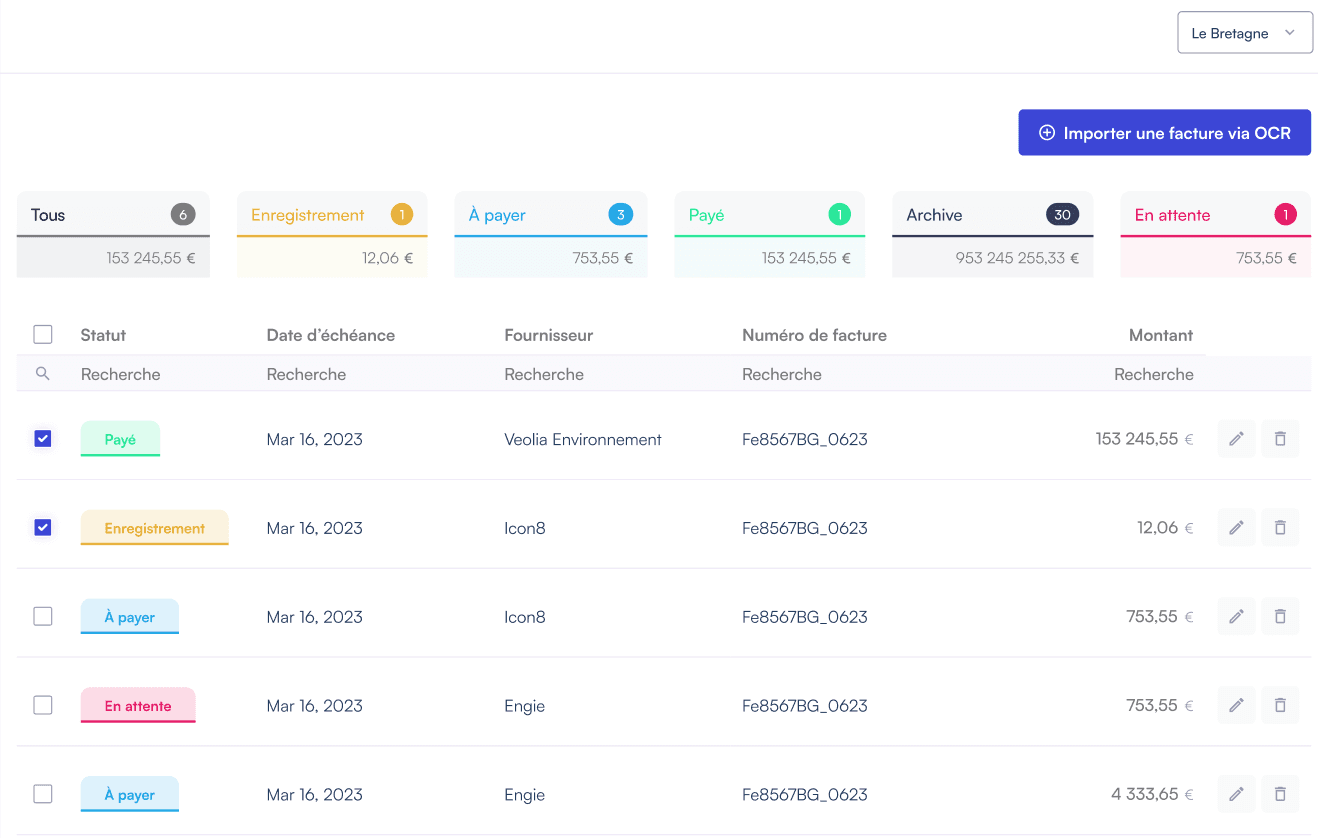

SaaS solutions for accounts payable management

Today, many businesses adopt SaaS financial management solutions. These solutions offer advanced automation, real-time monitoring, and support in managing relationships with their suppliers.

Automation

The advanced automation introduced by SaaS solutions in all accounts payable management processes has numerous advantages. Errors related to manual tasks are significantly reduced, accelerating invoice processing, payment term management, and all operations related to suppliers. The time saved through this automation allows employees or company leaders to focus on higher value-added activities.

Real-time monitoring

Companies have total visibility over all ongoing operations. SaaS solutions offer them fully customizable dashboards that allow for real-time monitoring of payments made or to be made, current supplier debts, various invoices, and contractual agreements with different suppliers. This monitoring greatly facilitates decision-making as well as cash flow forecasting.

Supplier relationship management

Features help keep communication channels with suppliers open, establish transparent collaboration conditions, and strengthen strategic partnerships.

An example of a SaaS solution: Qotid

Qotid is the all-in-one solution that supports the leaders of small and medium-sized enterprises and financial departments in their overall financial management. Equipped with multiple features in business intelligence, report generation, cash flow management, Qotid also proposes features for managing purchases. Numerous resources are implemented to allow leaders to better manage their supplier invoices. It is a collaborative platform that improves communication between teams, establishes invoice validation circuits for more effective organization. Qotid also offers visibility and real-time monitoring of cash flow, allowing leaders to make the most effective decisions possible.

SaaS solutions are therefore the answer for enabling businesses to effectively manage accounts payable. In addition to providing a perfectly automated solution that ensures real-time monitoring and includes supplier relationship management functionalities, these SaaS solutions guarantee the confidentiality of financial data, comply with constantly evolving regulations, and adapt perfectly to the needs of companies thanks to their high technology.

Thus, managing accounts payable is an important task that must be well executed and not neglected, as it has a direct impact on the company’s cash flow. Accounts payable plays an essential role in the company’s value chain, and its stakes represent a real lever that the company must exploit to optimize its cash flow as much as possible.

Ineffective management of accounts payable could have consequences for the financial health of the company. To face these risks, companies have a vested interest in investing in a SaaS solution like Qotid, which offers functionalities in accounts payable management that aim to support them in this process.

In summary:

Managing accounts payable is a key element of the financial health of a company. It involves managing relationships with suppliers, including contracts, payment terms, and debts to pay.

Accounts payable plays a strategic role in the sustainability of the company by ensuring the fluidity of the supply chain and avoiding potential disputes. It consists of various elements such as the number and diversity of suppliers, payment terms, negotiations, supplier debts, inventory volume, and working capital.

Good management of accounts payable enables a company to enhance its financial resources, have a reliable representation of real cash flow, and preserve commercial goodwill with suppliers. It is thus important to master negotiations with suppliers and regularly monitor the evolution of supplier debts to optimize cash flow.

F.A.Q:

Why is it important to master negotiations with suppliers?

It is important to master negotiations with suppliers to guarantee a reliable representation of the company's real cash flow and to preserve commercial goodwill with suppliers. Repeated and abusive negotiations or non-compliance with set deadlines can lead to a deterioration of the relationship with suppliers and an inability for the company to have a clear view of its real cash flow.

What are the elements that make up accounts payable?

Accounts payable consist of various elements such as the number and diversity of suppliers, payment terms, negotiations, supplier debts, inventory volume, and working capital. It represents how the company will manage its relationships with all its business partners on which it relies, whether for its raw materials, products, or services.

How can good accounts payable management enhance a company's financial resources?

Effective management of accounts payable ensures the fluidity of the supply chain, avoids potential disputes, and preserves commercial goodwill with suppliers. This can translate into good communication, consistent quality in the delivered products or services performed, increased reactivity to market fluctuations, negotiation opportunities, or even advantageous payment terms. All these elements can contribute to optimizing cash flow and increasing the financial resources of the company.