The importance of the cash flow statement for businesses

Amber Baynaud

•

Jul 8, 2024

Now more than ever, the sustainability of businesses relies on solid financial management. For SMEs and multi-establishment groups, making informed decisions lies in flawless control of their cash flow.

Among the tools that allow leaders to effectively manage their cash flow, the essential "cash flow statement" is found. Much more than a simple spreadsheet of numbers, the cash flow statement is the barometer that measures the financial health of a business.

In this article, we will explore in detail what a cash flow statement is, the mistakes to avoid when preparing it, and the importance for businesses to correctly interpret it.

It is indeed essential for managers and financial officers seeking to optimize their financial management to understand the nature and components of this strategic tool.

What is a cash flow statement?

The cash flow statement is a true financial compass for businesses. It is defined as an essential management tool that allows for the analysis and visualization of cash flows (inflows and outflows) of an organization over a given period. Financial reports such as the balance sheet, income statement, or cash flow statement have different objectives and consist of flows of different natures. The cash flow statement, specifically, focuses on the cash inflows and outflows of the business. You can find out more in another article about the differences between these financial reports.

This statement provides a clear view of liquidity availability, indicating how money circulates within the company. In other words, it answers the question: "What amount of money comes into the business, and what amount goes out?".

The cash flow statement serves as a reference point to assess a company's ability to meet its financial obligations, invest in new opportunities, or face potential economic challenges. It accounts for what has been received and paid out during the month and relies on this data to anticipate future inflows and outflows. It is a predictive tool that allows financial managers to make informed decisions by anticipating their potential cash flow needs.

What are the components of a cash flow statement?

As we explained, the cash flow statement aims to quantify and anticipate the financial situation of a business. It only takes into account the incoming and outgoing cash flows of the company.

To create the most effective cash flow statement possible, it is important to inventory all the inflows and outflows that the company has made.

Now, let's review the terms you encounter most often in your daily activities that represent the majority of a company's inflows/outflows, in general.

The inflows represent the company's incoming cash flows:

Customer receivables including taxes,

Sales,

Subsidies to be received,

Loans,

Cash contributions or associated accounts,

Tax credit refunds,

Proceeds from asset disposals.

The outflows represent the company's outgoing cash flows:

Supplier debts including taxes,

Purchases,

Taxes,

Personnel costs,

Fixed assets,

Dividends.

It will then be important to subtract the total outflows from the total inflows; the goal is to find the net cash amount at the end of the month. It is desirable for this cash amount to be positive to ensure the financial stability of the business.

How to create an effective cash flow statement?

The design of a performance-oriented cash flow statement relies on a methodical approach that begins with a thorough analysis of various accounting documents. First, gather these documents to extract all the information regarding your company's financial health. The income statement will assess self-financing capacity, the balance sheet will inform about the company's assets, and the financing statement will reveal variations in working capital needs.

It is essential to pay particular attention to inflows and outflows, list them, and identify them to obtain an accurate representation of the cash flow. The accuracy of this statement is crucial for developing medium- and long-term projections.

Moreover, it is imperative to regularly update the cash flow statement to best adjust forecasts. One must also be careful when making assumptions related to VAT calculation, payment terms, seasonal variations, exceptional charges, etc.

At the end of each month, comparing the actual cash flow statement with the projected cash flow statement allows for identifying the types of inflows that impact cash flow needs or surpluses.

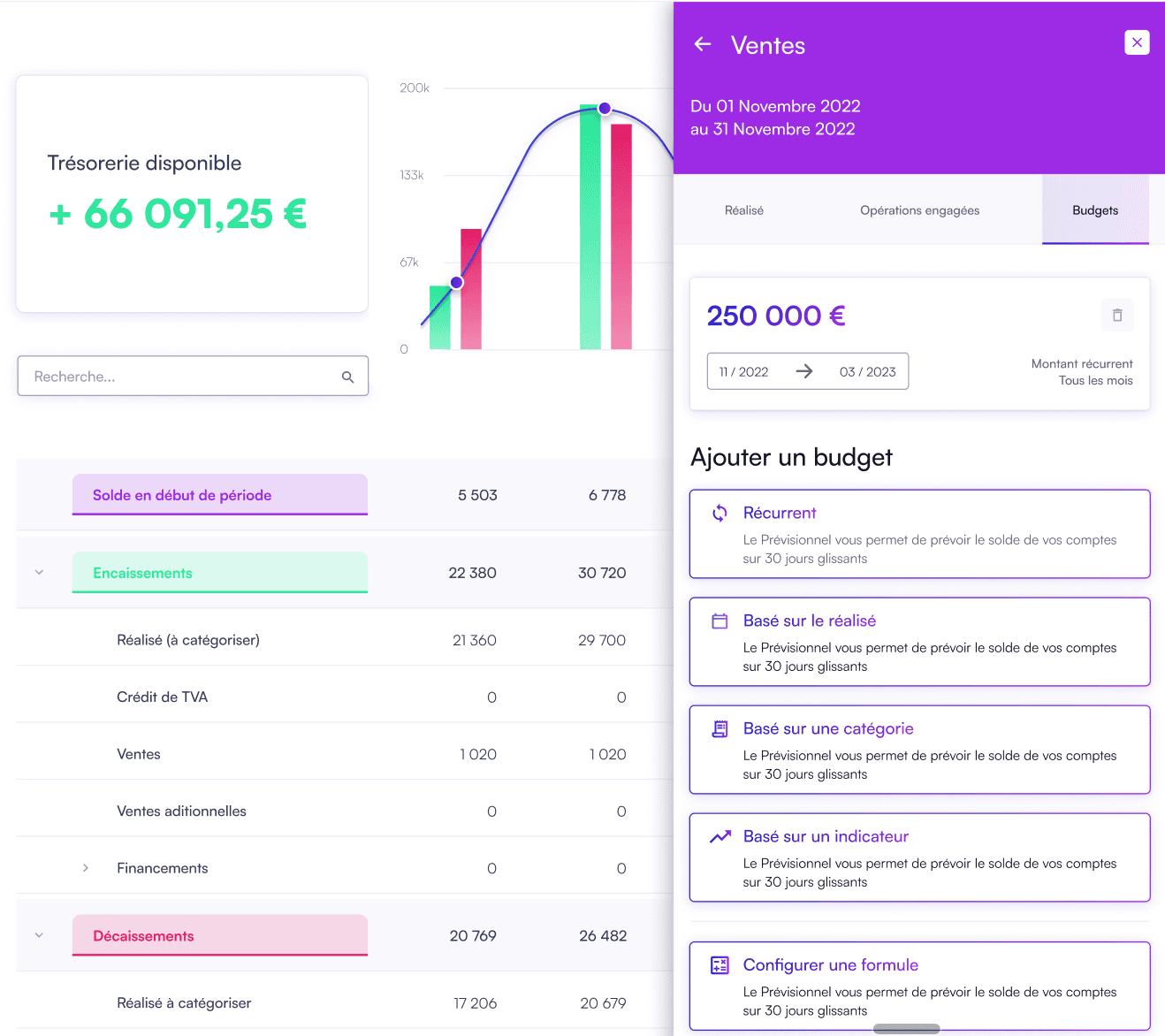

Currently, many software solutions facilitate the creation of cash flow statements. Qotid, for example, offers complete support for creating your cash flow budgets, simplifying this financial management process.

Common mistakes to avoid

The design of a cash flow statement, while essential, can be a tedious task. To ensure the representativeness of the calculated data, it is imperative to guard against certain mistakes frequently made by business leaders.

Here are some of them:

Payment terms

During a transaction, whether for a purchase or a sale, payment terms may be stipulated by suppliers or negotiated with clients. It is essential to understand that the cash flow statement reflects the overall cash flows that occurred during the month. For example, if a product is purchased with a supplier payment term of 30 days, the cash outflow will only occur after 30 days, that is, the following month. Therefore, it is important not to include this amount in the current month's cash flow statement but in the following month's.

Seasonal variations

When establishing a cash flow statement, it is imperative to account for seasonal variations and their impact on the company's business. For example, a restaurant located on the Brittany coast will experience significantly higher activity in summer than in winter. It is crucial to adjust the cash flow statement accordingly and to anticipate the amounts of inflows and outflows that are most representative of reality.

Amounts including taxes

Unlike the balance sheet or the income statement, which present elements excluding taxes (net), the cash flow statement is fully inclusive of all taxes (gross). Since it accounts for all cash flows (including all money paid, whether for a purchase or a banking transaction), the amount of a product or service must be accumulated with its VAT, even if the latter is refunded the following month by the State.

VAT calculation

When calculating the VAT to be paid, it is essential to consider, for each item, its month of eligibility (which varies depending on whether it is a good or a service), as well as the VAT due from the previous month.

Regular updates

Do not wait until you are in the red to update your cash flow statement. Its purpose being to visualize the financial situation of the business, regular updates are essential to avoid any distortion of this representation. Thus, keeping the statement regularly updated ensures an accurate view of your company's financial health.

How often should we create a cash flow statement?

As mentioned earlier, the frequency of updating a cash flow statement plays an important role in its effectiveness. Although daily cash management may not be necessary, keeping the statement updated with each new transaction, sale, or event generating cash flow is highly recommended. Ideally, it should be updated every week or, at minimum, once a month.

This regular update practice naturally adapts to the size and complexity of the business. The larger and more complex a company is, the more numerous its cash flows will be. Consequently, it becomes essential to keep the cash flow statement updated even more frequently. Diligence in updating ensures an accurate and up-to-date view of the financial situation, guaranteeing effective management.

How to interpret a cash flow statement?

When establishing a cash flow statement, we must calculate the difference between inflows and outflows. The result obtained constitutes the cash amount for the month, which can be either positive or negative. This distinction leads to two possible cash flow scenarios.

Positive cash flow

Positive cash flow means that cash inflows exceed cash outflows. In other words, it means that the company has the capacity to meet all its needs without resorting to external financing.

With positive cash flow (or cash surplus), the company has several possibilities. It can for example:

Reinvest this surplus to promote the company's growth,

Repay its debts,

Anticipate and build reserves,

Distribute dividends to shareholders.

Negative cash flow

Negative cash flow occurs when cash outflows exceed cash inflows, indicating that the company does not have the necessary external financing to cover all its needs.

This cash need can have various origins. It may result from a substantial investment that, while having facilitated the development of the company, has not yet been fully utilized. Similarly, it may be caused by a significant debt repayment or too short supplier payment terms, forcing the company to quickly disburse funds to meet its financial commitments. This is why it is essential to delve into this cash flow to identify the reasons for its negative balance.

To learn more about cash flow needs, consult our detailed guide.

In the face of negative cash flow, the company has several options to restore financial balance, including:

Reviewing payment terms: shortening deadlines with clients to speed up the collection of receivables and negotiating longer terms with suppliers.

Disposing of non-essential assets to the business.

Exploring external financing solutions to strengthen cash flow.

Understanding the origins and solutions for negative cash flows allows the company to take strategic measures to overcome these financial challenges and ensure informed liquidity management.

Example of organizing a cash flow statement

The layout of cash flow statements can vary depending on each business's specificities. Although the distinction between inflows and outflows remains fundamental, it is possible to go further by calculating ratios and classifying these flows into different categories, which we will explain.

Some companies choose to classify all their inflows and outflows into three types of distinct flows:

Cash flows related to operations,

Cash flows related to investments,

Cash flows related to financing.

This segmentation allows these companies to calculate the difference between inflows and outflows according to these types of categories. This allows for identifying which categories most influence cash flow, either positively or negatively, and offers a more precise understanding of each flow's contribution to the company's financial situation.

Following this analysis, companies can calculate various ratios, such as the self-financing capacity (CAF), which helps determine if the company can finance all its needs with its available resources.

The available cash amount, obtained at the end of this statement, offers a tangible view of the company's financial situation.

Qotid helps you with your cash flow statements

Cash management requires rigor and precision to achieve maximum effectiveness. This exercise, a true ally in strategic decision-making, loses its relevance if poorly executed. Solutions like Qotid emerge as partners in creating this cash flow statement.

Equipped with specific cash management features, Qotid provides its users with real-time tracking of all their inflows and outflows thanks to its connections to multiple banks of the business. This feature grants leaders complete visibility over all their cash flows.

Qotid then allows its users to create projected cash flow statements and explore various scenarios. The objective is to facilitate forecasts about the company's financial situation in the medium or long term, thus offering a strategic perspective.

Furthermore, the cash flow statement is automatically updated based on invoice due dates.

Finally, Qotid offers users the possibility to compare these projected results with actual results. All data is pre-collected, and these results can be integrated into dashboards. Users can thus identify areas exhibiting the most significant discrepancies between actual and projected figures, allowing for suitable solutions.

The cash flow statement is, as you will have understood, an indispensable tool for financial management in the business. Providing the ability to report and anticipate all inflows and outflows, the cash flow statement enables leaders to make informed decisions and steer the financial performance of their company.

Its preparation requires rigor and precision to guarantee an accurate representation of the company's financial health.

Finally, this often tedious task can, when done manually, reveal errors often related to VAT calculation, payment terms, or seasonal variations. That is why many solutions like Qotid assist businesses in creating these cash flow statements.

A downloadable cash flow statement template

If you are starting your business and have no choice but to manage your cash flow on Excel, we have put together a cash flow statement template that we hope will be useful to you 👇

In summary:

The cash flow statement is an essential management tool for businesses, allowing analysis and visualization of incoming and outgoing cash flows over a given period. It provides a clear view of liquidity availability and how money circulates within the business.

The inflows represent incoming cash flows, such as customer receivables, sales, and loans, while the outflows represent outgoing flows, like supplier debts, purchases, and personnel costs. To create an effective cash flow statement, it is important to gather all accounting documents, identify and list inflows and outflows, and regularly update the statement.

The accuracy of this tool is essential for developing medium- and long-term projections and making informed decisions. It is also crucial to avoid certain mistakes, such as not accounting for payment terms, ignoring seasonal variations, and failing to regularly update the statement.

F.A.Q:

1. What is a cash flow statement and why is it important for businesses?

A cash flow statement is a financial management tool that allows businesses to track and analyze their incoming and outgoing cash flows over a given period. It provides a clear view of liquidity availability and how money circulates within the company.

The cash flow statement is important for businesses because it enables them to make informed decisions regarding financial management, assess their capacity to meet financial commitments, and anticipate future cash flow needs.

2. What are the inflows and outflows to consider in a cash flow statement?

The inflows represent the incoming cash flows of the business, such as customer receivables, sales, subsidies to be received, loans, cash contributions, tax credit refunds, and proceeds from asset disposals.

On the other hand, outflows represent outgoing cash flows, such as supplier debts, purchases, taxes, personnel costs, fixed assets, and dividends. It is important to account for all inflows and outflows to have an accurate view of the company's financial situation.

3. What are common mistakes to avoid when preparing a cash flow statement?

Common mistakes to avoid when preparing a cash flow statement include:

- Not accounting for payment terms: It is important to consider the payment terms of clients and suppliers for an accurate understanding of cash flows.

- Ignoring seasonal variations: Some businesses experience larger cash flows at certain times of the year, hence it is important to factor in these seasonal variations to anticipate cash flow needs.

- Failing to regularly update the cash flow statement: It is essential to maintain regular updates to the cash flow statement to have an accurate and timely view of the company's financial situation.

- Not accounting for exceptional inflows and outflows: Exceptional inflows and outflows, such as investments or asset disposals, must be included in the cash flow statement for a complete view of the company's financial situation.