The 6 best treasury software

Amber Baynaud

•

Oct 24, 2024

The management of cash flow can be seen as the financial lung of the company. In the business world, it refers to the total cash available to the company, that is, the money that can be immediately mobilized in the bank. It is truly a pillar that allows any company, regardless of its size, to thrive and grow.

A positive liquidity allows the company to operate its business through various investments, ensuring financial flexibility capable of adapting to different changes or unforeseen events.

It is therefore crucial to take control of this element, as it allows you to steer the financial health of the company.

More and more companies today are turning to a cash flow tracking software. The goal? To allow business leaders to obtain a simplified analysis and automated management of their cash registers, in order to have a clear view of their available cash and adapt their decisions accordingly.

What is cash flow software?

It is a tool specifically designed to help leaders optimize the financial management of their company. These digital solutions feature very advanced functionalities, the primary one being real-time tracking of the company's liquidity or creating scenarios to anticipate future cash flow.

The cash flow management tool simplifies and automates the entire financial management process. Its main function is its ability to connect to the company's banks. All flows considered as banking operations (payments, transfers, etc.) are therefore entirely centralized within the software.

In general, all of the collected data is combined with other data coming from customer and supplier invoices, cash register software, etc. The software processes them entirely and thus creates customizable dashboards that provide an overview of the company's situation.

This type of software can differ in terms of the number of features they offer. We can distinguish two types of solutions in this field:

Generalist software: they cover more general needs regarding business management (purchase management, accounting, etc.). For example: Axonaut, Qotid, Pennylane.

Specialized software: they cover specific needs in cash management. The functionalities offered on specialized software are therefore sometimes more advanced than those on generalist software. For example: Agicap, Kyriba.

The best cash flow software: our comparison

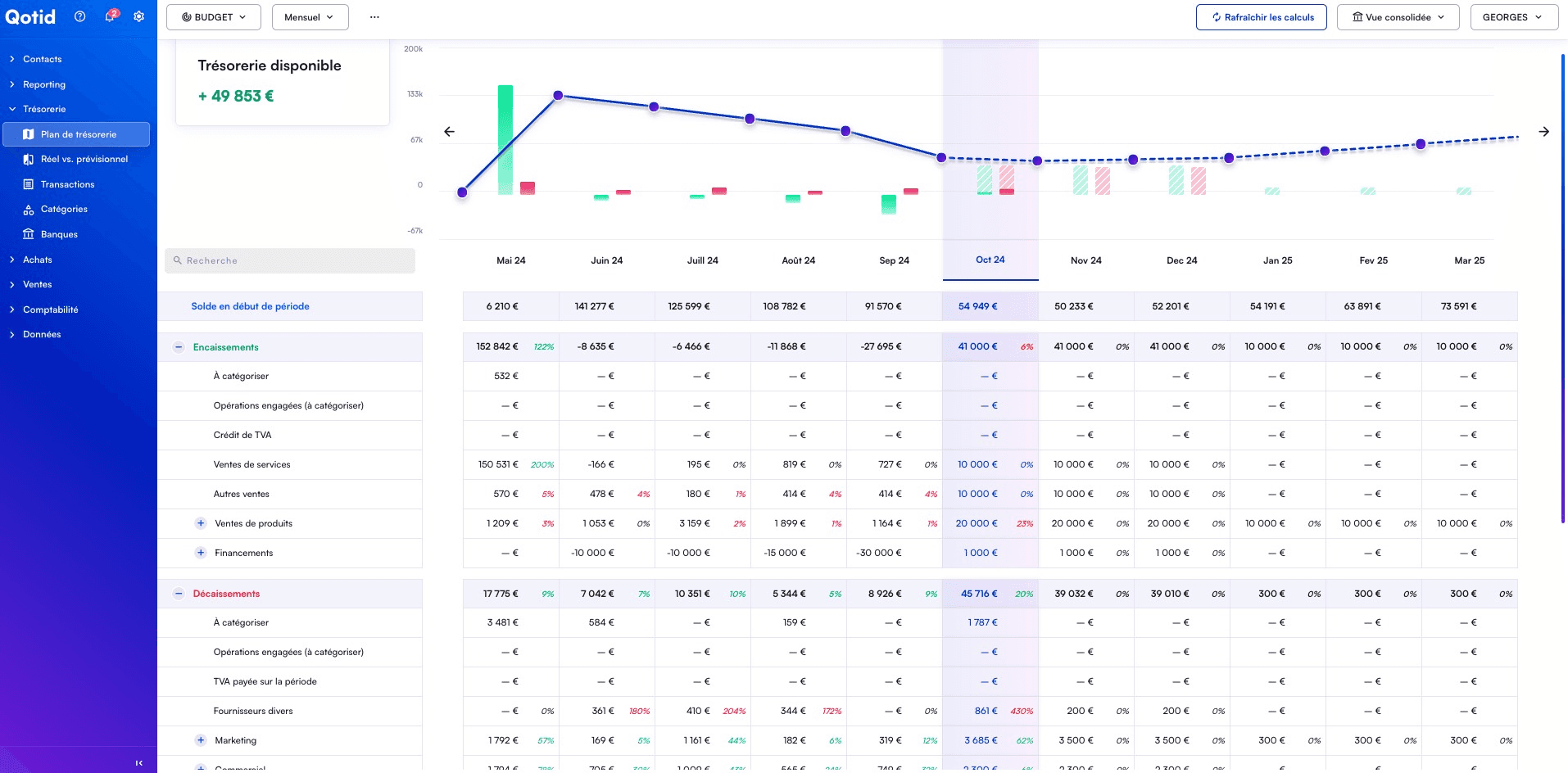

1. Qotid

Advantages:

Qotid positions itself as one of the most accessible all-in-one solutions on the market, ideal for multi-site groups as well as micro-enterprises and small and medium-sized enterprises (SMEs). This software offers a modern and intuitive interface, allowing users to easily manage their entire financial activity without requiring technical skills thanks to its no-code approach. Qotid covers essential features for financial management, including purchase management, business intelligence (BI) / reporting, and of course, management of cash flow. The software allows leaders to track their liquidity in real-time with automated tools such as connection to over 200 banks, automatic categorization of flows, and creation of reliable forecasts and scenarios.

Disadvantages:

One of the main limitations of Qotid is the lack of a mobile application, although one is planned for the end of 2024. For companies looking for mobile management right now, this can be a disadvantage.

Target audience:

Qotid particularly targets micro-enterprises, SMEs, mid-sized enterprises (ETIs), and multi-site groups. It is also ideal for financial departments looking for a centralized and easy-to-use tool to proactively manage their cash flow.

Pricing:

The rates for Qotid start at €49 excl. tax per month for micro-enterprises, with plans that evolve according to the size and specific needs of the company. Larger groups, such as ETIs and multi-sites, can access more advanced features for additional costs adjusted to the complexity of the solution in place.

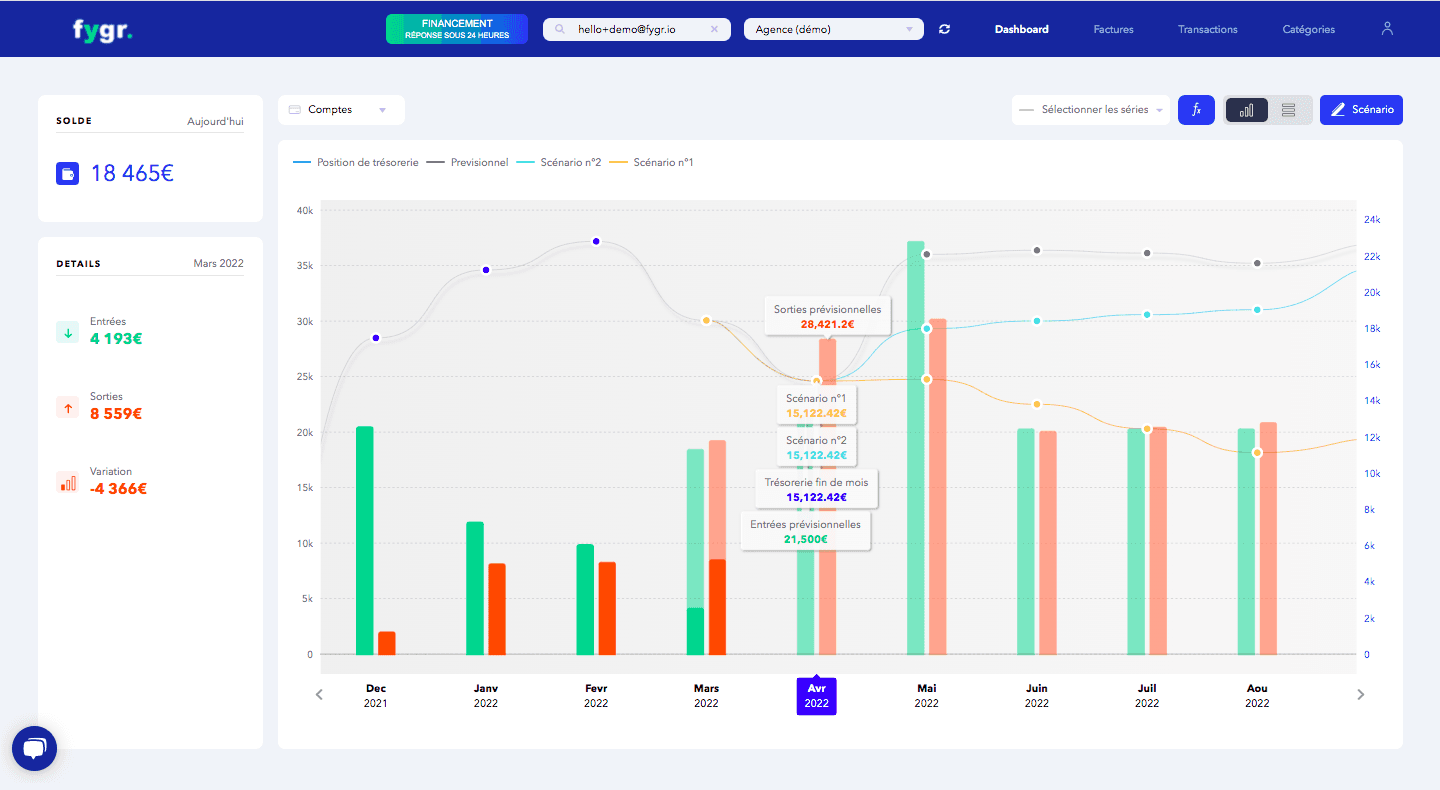

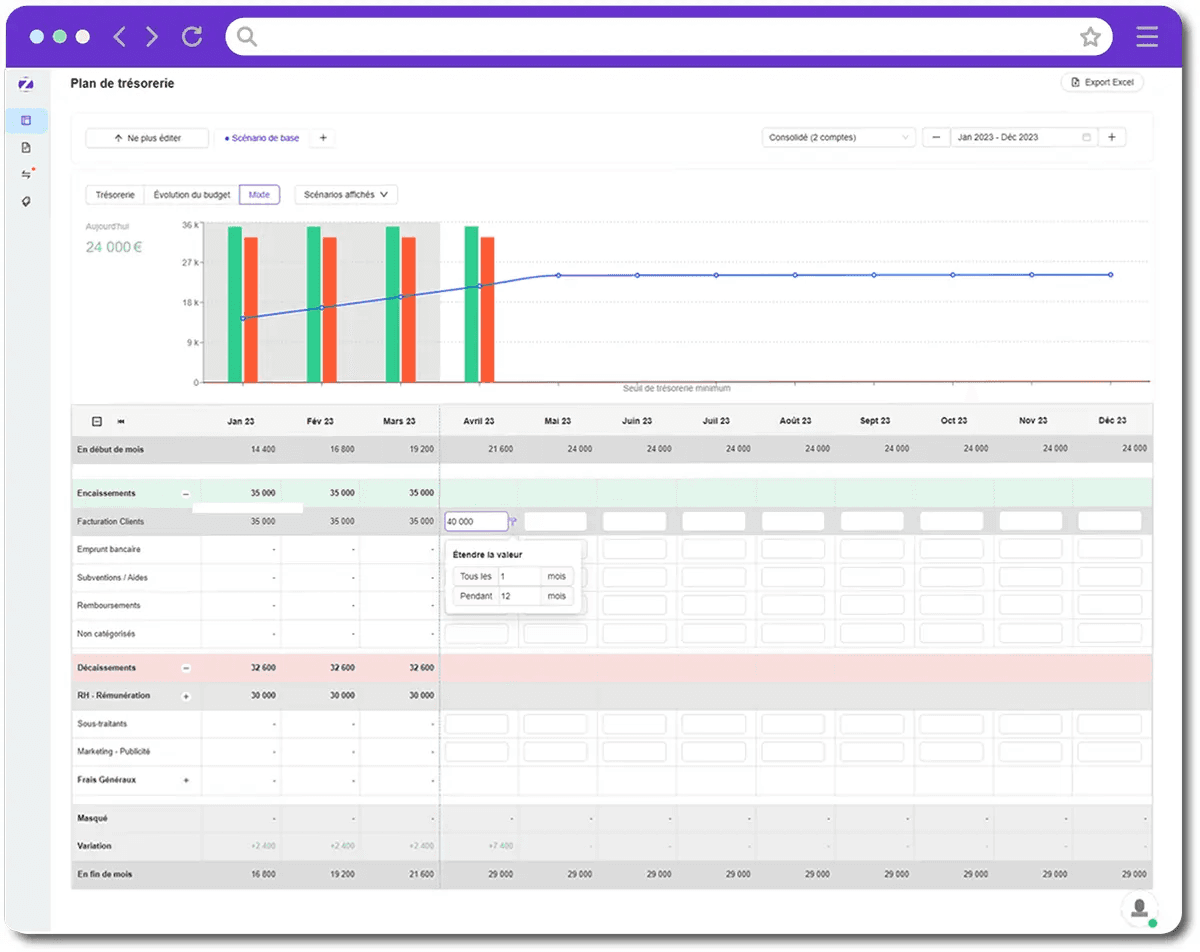

2. Fygr

Advantages:

Fygr stands out for its ability to provide an essential decision-making tool, mainly focused on cash management and forecasting for micro-enterprises and SMEs. This software is known for its intuitive and user-friendly interface, allowing users to quickly grasp key functionalities such as the clear representation of bank flows and custom forecasts. Fygr's flexibility makes it an ideal tool for companies looking to improve their visibility over their liquidity. Another strength is the efficiency and responsiveness of customer support, which allows users to quickly receive tailored responses to their needs.

Disadvantages:

The main drawback of Fygr lies in its limited integrations with accounting software. This can be a hurdle for companies wishing to automate their financial management further. Additionally, Fygr does not offer a mobile application, which can disadvantage companies looking to monitor their cash flow on the go.

Target audience:

Fygr is designed for startups, micro-enterprises, SMEs, ETIs, and even associations looking to enhance their cash management while benefiting from a simple and affordable tool. Companies needing a quick and intuitive financial forecasting solution will be particularly attracted to Fygr.

Pricing:

The rates for Fygr start at €59 excl. tax per month, with variations depending on the number of connected banks and the specific cash forecasting needs. Additional options may be offered for companies with more complex requirements, particularly in terms of connectivity and data volume to be processed.

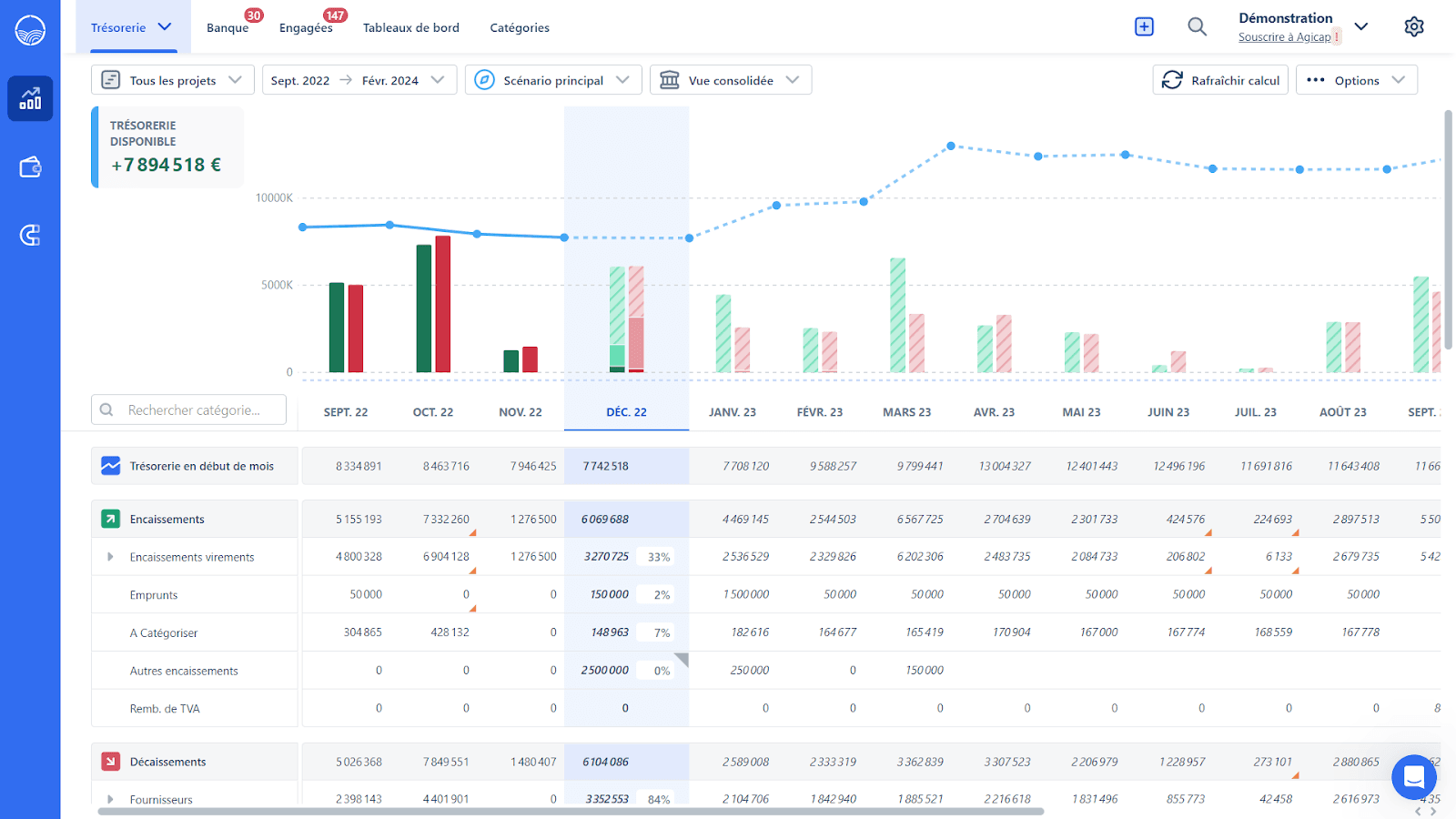

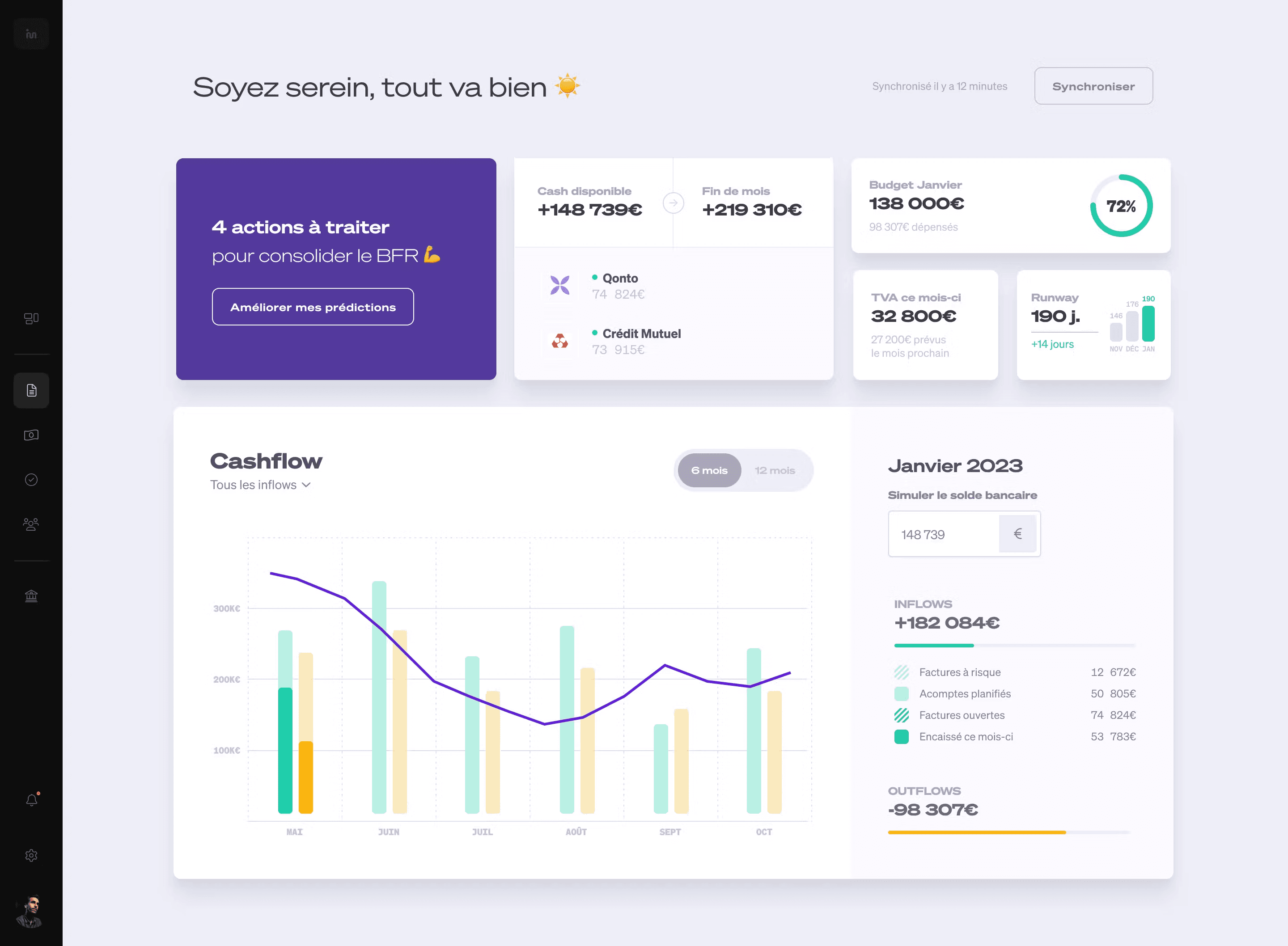

3. Agicap

Advantages:

Agicap is widely recognized as the French leader in cash management and forecasting. Its strength lies in its ability to offer advanced automation of financial flows, providing immediate visibility over cash flow movements. In addition to its basic functionalities, Agicap offers an intelligent forecasting tool that allows companies to make informed decisions based on various financial scenarios. With these strengths, companies can anticipate their liquidity needs and adjust their strategy accordingly, which is crucial for their growth and stability.

Disadvantages:

The prices for Agicap are available only upon request, which can pose an obstacle for companies seeking transparency in costs. Additionally, the free trial of only 24 hours does not allow for a full test of all functionalities. Finally, the commitment is annual, which means that users can only cancel after a year of use, limiting flexibility.

Target audience:

Agicap is particularly suited for micro-enterprises, SMEs, and ETIs looking for a robust solution to manage and anticipate their flows with great precision. This software is suitable for companies with advanced forecasting needs and who wish to automate their financial management to the maximum.

Pricing:

Prices are only available upon request, which may vary depending on the company's size and specific needs. Interested companies should directly contact Agicap for a cost estimate based on their structure and financial objectives.

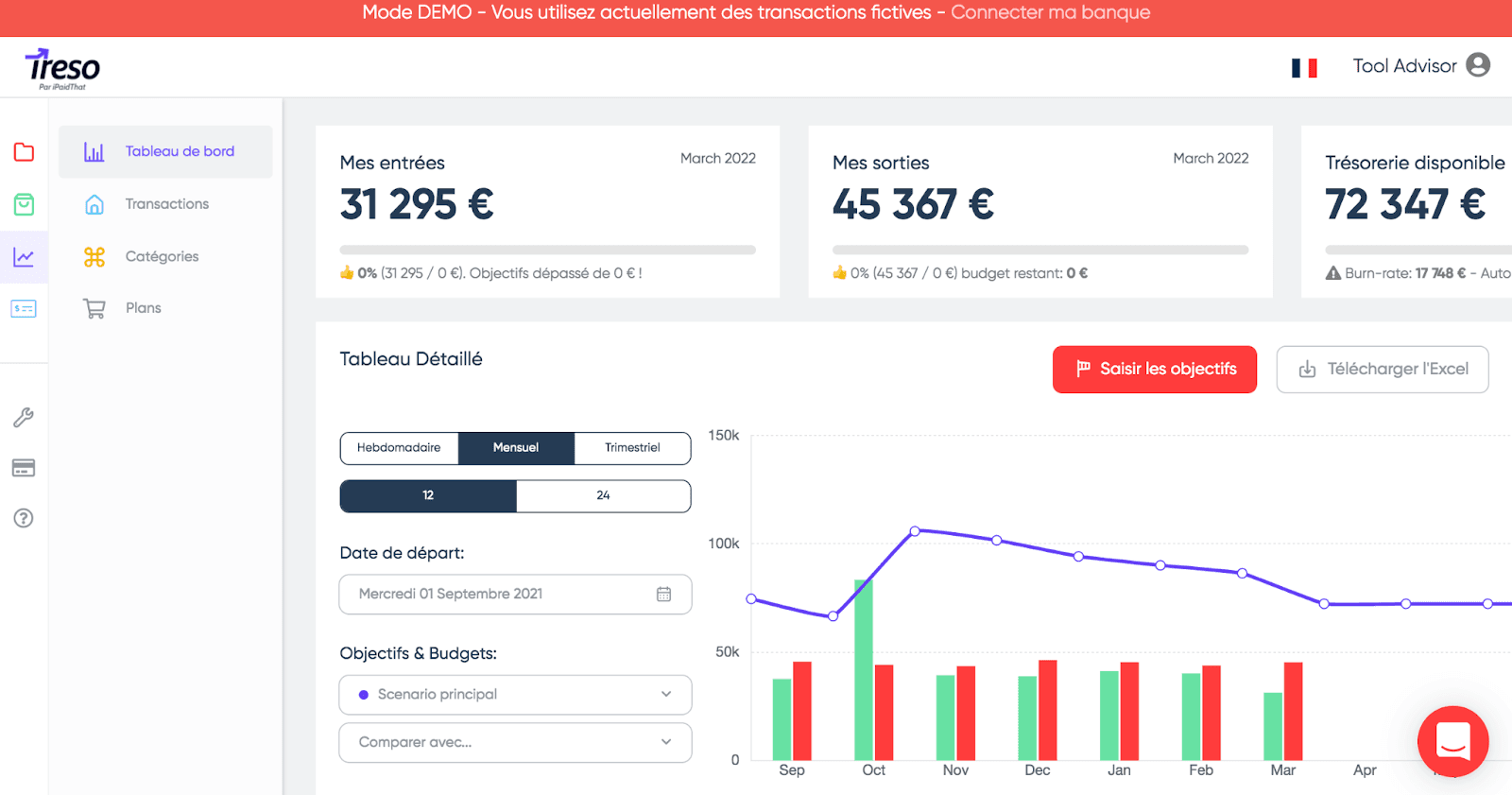

4. IpaidThat

Advantages:

IpaidThat is a software designed to simplify and automate the financial and accounting management of companies. The platform is entirely online, allowing for real-time bank synchronization as well as a dedicated mobile application for managing expense reports, a major asset for companies on the go. IpaidThat also stands out with advanced features such as automatic bank reconciliation and classification of accounting documents, ensuring a clear view of the company's financial health at all times.

Disadvantages:

However, IpaidThat is more of a pre-accounting software than a true cash flow monitoring tool. Thus, it may not suit companies looking for software specifically dedicated to financial flow management.

Target audience:

IpaidThat primarily targets entrepreneurs, startups, and micro/small and medium-sized enterprises (SMEs) looking to automate their accounting while having an easy-to-use solution to manage financial documents and banking flows.

Pricing:

Rates start at €59 excl. tax per month, making it an affordable solution for small businesses. However, additional costs may apply depending on the number of users or desired additional services, particularly for advanced invoice management and integrations.

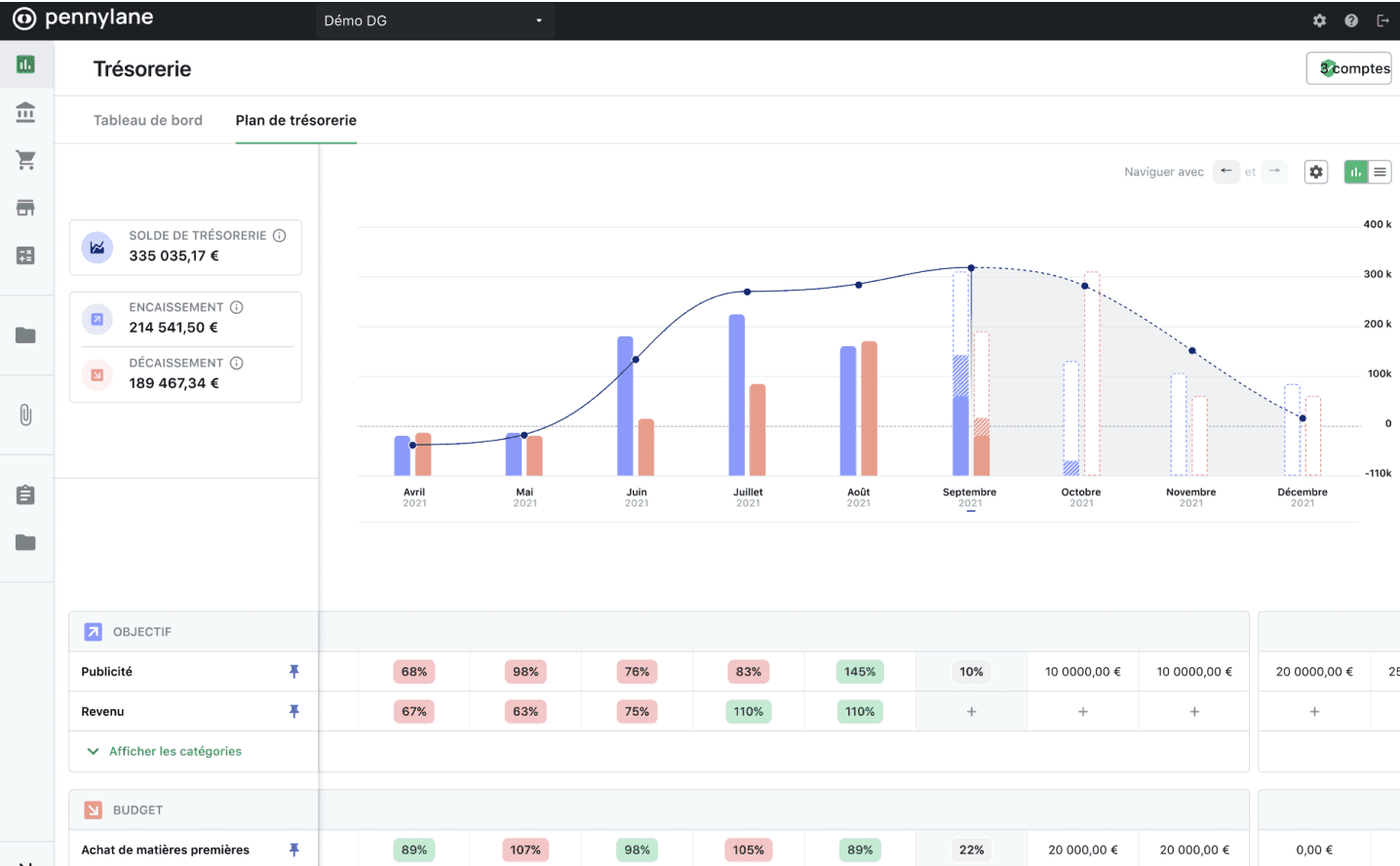

5. Pennylane

Advantages:

Pennylane positions itself as an all-in-one financial management platform with rapid developments and great ease of use. This software offers smooth integration with other accounting tools, allowing for centralized management of financial flows. Pennylane has a mobile application, providing instant access to financial data even on the go, and offers a dedicated customer support system to assist businesses in managing their cash flow and accounting.

Disadvantages:

Not all modules of Pennylane are equally developed, particularly the cash management module which remains more limited compared to the accounting module. Additionally, some users have reported a lack of responsiveness from customer service, which can be a hindrance for companies requiring immediate support.

Target audience:

Pennylane is primarily aimed at startups, micro-enterprises, and SMEs looking for an integrated solution to manage both their accounting and cash flow, with a focus on simplicity and centralization of financial data.

Pricing:

Prices start at €14 excl. tax per month, with a pricing structure that evolves based on the number of employees and activated modules. This makes it one of the most accessible solutions on the market, although some additional services may increase costs based on the specific needs of the company.

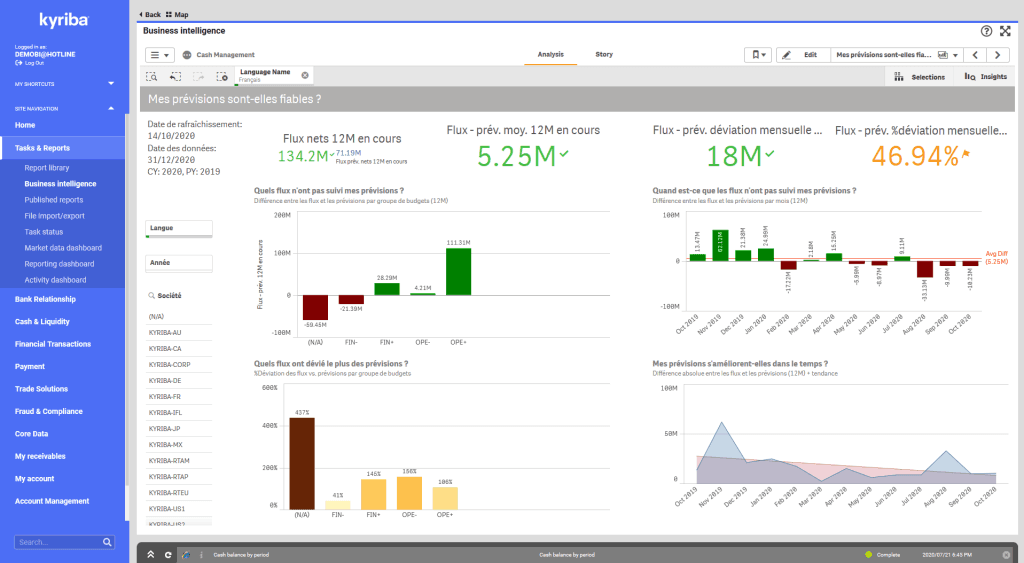

6. Kyriba

Advantages:

Kyriba is the global leader in cash management and financing solutions in the Cloud. It stands out with a particularly innovative offering, including features such as financial risk management. With an intuitive mobile application, Kyriba offers direct visibility over financial flows and allows for optimized liquidity management on a global scale. Its advanced technology makes it an indispensable tool for large companies seeking to optimize their financial management and forecasting.

Disadvantages:

One of the main drawbacks of Kyriba is the lack of visibility into pricing, which can complicate comparisons with other solutions. Furthermore, the implementation of the software can prove complex for some companies, and some users report that certain modules do not always adequately meet their needs.

Target audience:

Kyriba is particularly designed for SMEs, ETIs, and large groups that require a robust and scalable solution for management.

Pricing:

Upon request.

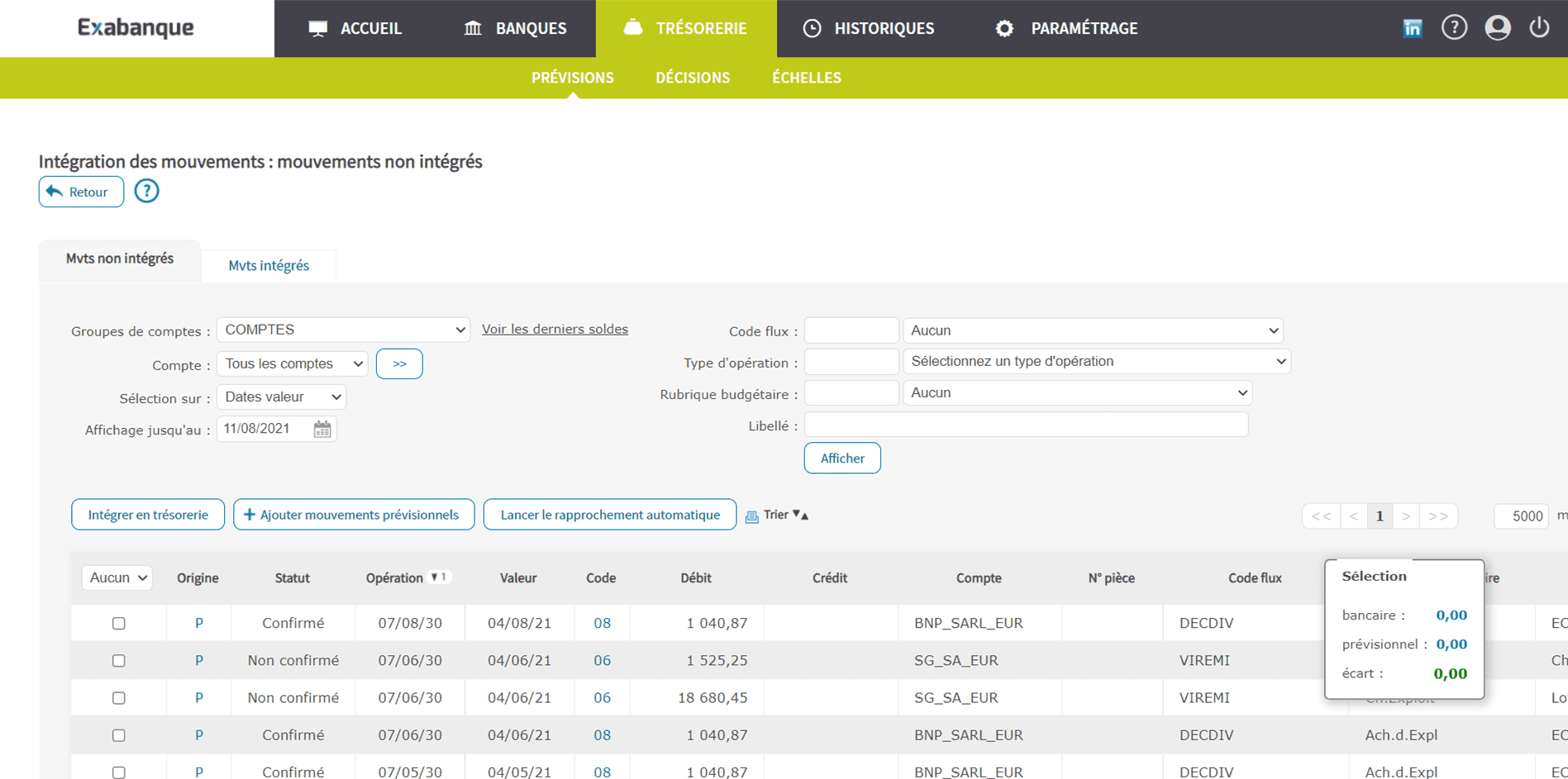

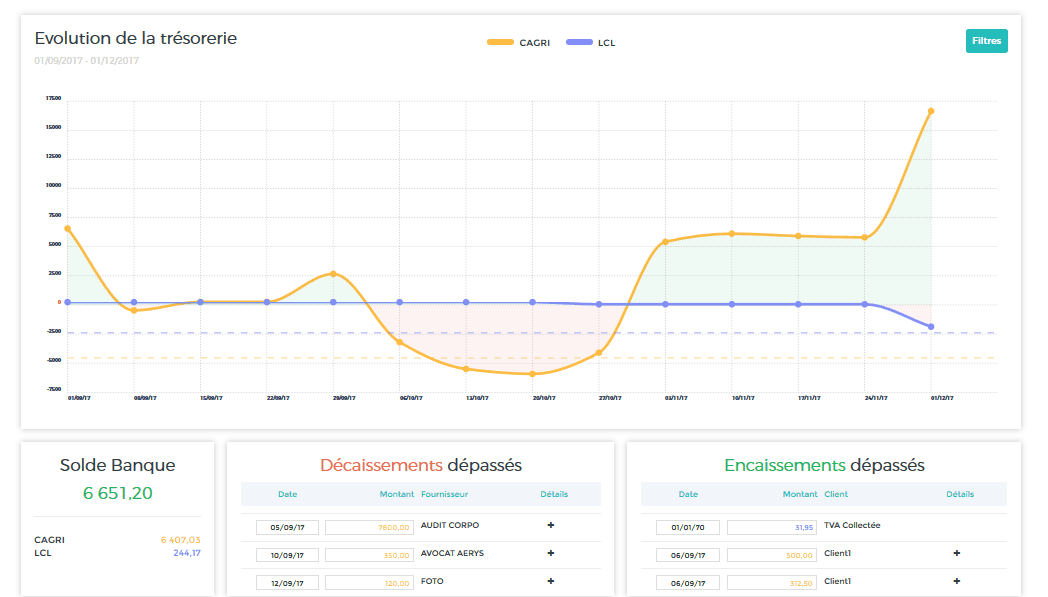

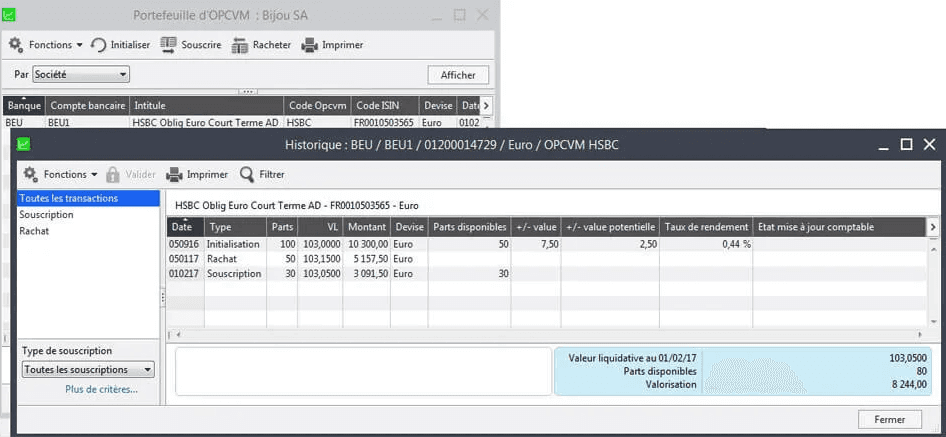

7. Cegid Exabanque

Advantages

Exabanque is a software publisher specializing in cash management that has joined the Cegid group. The latter is dedicated to SMEs, similar to the solutions mentioned earlier, Exabanque also has multi-bank connections and allows you to optimize cash flow and your investments through an easy-to-use interface.

It allows you, among other things, to have a global view of the economic health of your company, in order to establish a so-called "macro" analysis of your finances.

Exabanque also allows you to view your projected balances for each company integrated into the software, thus providing you with a graphical visualization of your budget simulations, helping you make more informed decisions.

Disadvantages

Be prepared for additional costs in the initial pricing to connect more bank accounts, in particular. Moreover, Exabanque is not available for accounts domiciled outside of Europe. One can also point out the design of the interface, which is indeed easy to use but not as attractive compared to some competitors.

Target audience

SMEs.

Pricing

€69/month, excluding available options. It is better to know your needs precisely before choosing the options that suit you.

8. Zenfirst

Advantages

Launched in 2020, Zenfirst is a web application for cash flow management and invoicing. Its interface has the advantage of being simple to use, far from the complexity of an Excel spreadsheet, and thus offers good visibility of your finances. This application also allows you to sync your bank accounts and your accounting data from other software. It also provides you with a chat to assist you and offers a free version.

Disadvantage

The free version only accounts for one bank, which can be very limiting if you are a growing micro-enterprise. Moreover, the functionalities are not suitable for large groups and it is a pity that this web application only exists on PC and not in mobile version.

Target audience

Zenfirst is primarily aimed at small businesses, even freelancers. The paid version evolves according to the needs of the company, which could result in a fairly high price.

Pricing:

The rates for Zenfirst start at €0 excl. tax if you only connect one bank, but it should rather be seen as a free trial version. For actual use, you should count around €66 excl. tax per month. This price varies according to the number of connected banks and can increase quite quickly, in addition to requiring a commitment.

9. Irma

Advantages:

Irma is a financial management software specialized in cash flow management and forecasting. It is distinguished by its ease of use and its accuracy in financial analyses. It provides medium and long-term forecasts with an intuitive interface that allows users to easily visualize financial data and monitor accounts in real-time. Irma is ideal for users looking for a cash-focused solution without overly complex or diversified functionalities.

Disadvantages:

Relying on a flexible price can be destabilizing, especially since one does not know if a minimum rate is set. Moreover, one might also wonder what level of support and which functionalities are accessible from the set price, although this can be modified. There is a legitimate question regarding the relevance of this gamble on a flexible price in terms of time-saving. It is thus a double-edged concept.

Target audience:

Irma mainly targets individual entrepreneurs and SMEs who need simple and effective monitoring of their cash flow without burdening themselves with additional tools. It is particularly suitable for companies looking to enhance their financial visibility without entering into more complex systems.

Pricing:

Irma offers a flexible price, in other words, you give it the price you are willing to allocate. This price can be subject to change thanks to a flexible plan depending on the size of the company and the necessary functionalities.

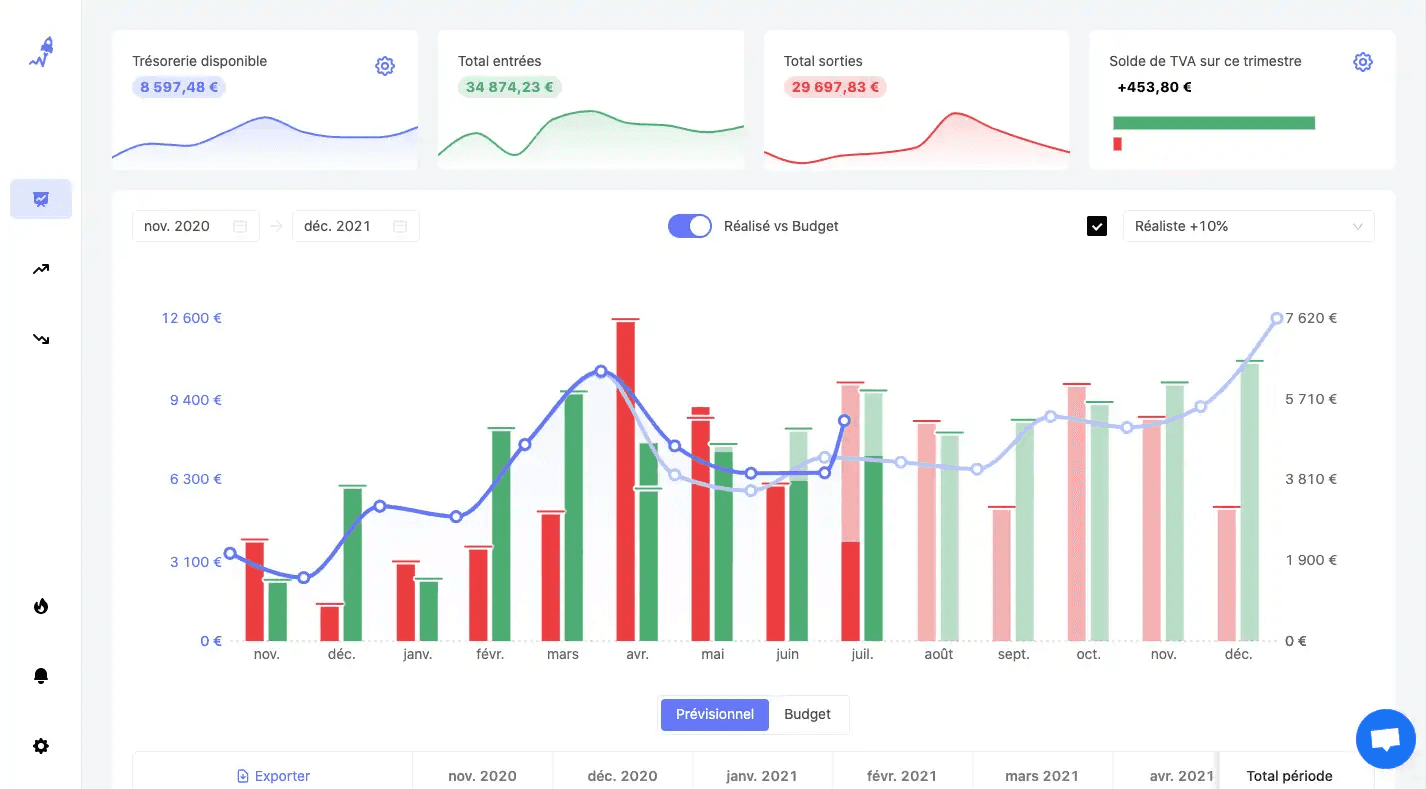

10. RocketChart by Sellsy

Advantages:

RocketChart is a solution specialized in cash management with a strong focus on forecasting and visualizing financial flows. It was integrated into the CRM Sellsy in 2022 to complement its offering. RocketChart offers a modern and sleek user interface, with clear graphs and reports that allow for quick and intuitive decision-making. RocketChart is perfect for companies wanting an immediate visual overview of their financial situation. It is also compatible with different accounting software, allowing for seamless integration into existing processes.

Disadvantages:

RocketChart primarily focuses on cash management and lacks additional modules such as sales management or invoicing. Its visual orientation may also not suit users who prefer a more classic and text-based interface.

Target audience:

RocketChart is aimed at startups, SMEs, and scale-ups that need visual financial forecasting and seek a solution dedicated to managing cash flows.

Pricing:

Prices for RocketChart start at €29 per month for micro-enterprises and rise to €49 for SMEs, all with evolving options based on the number of users and advanced forecasting needs.

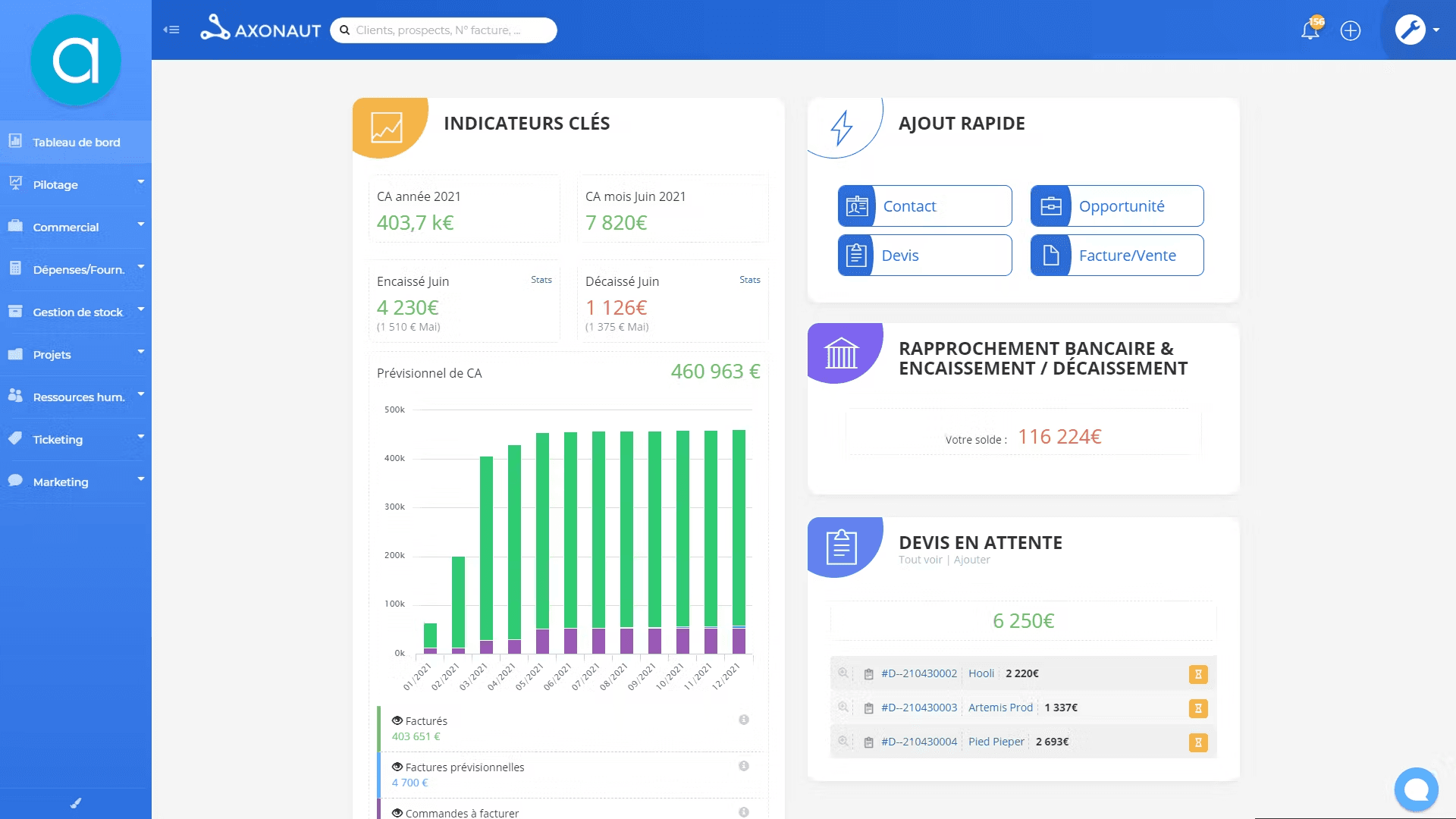

11. Axonaut

Advantages:

Axonaut is a French all-in-one business management solution, particularly suited for micro-enterprises and SMEs. It stands out for its comprehensive offering that includes not only cash management but also modules such as invoicing, quote management, CRM for customer relations, and project management. The main advantage of Axonaut is that it centralizes all these functions in an intuitive interface, allowing small structure leaders to easily manage their entire operations without juggling between different software. The automated bank connection, along with the tools for tracking payments and invoices, provides a complete view of cash flow in real-time. Axonaut also positions itself as a no-code software, meaning no technical skills are required for its use.

Disadvantages:

The main drawback of Axonaut is that some features may seem limited for medium-sized businesses or structures with very specific cash management needs. Additionally, some integrations with other accounting software may lack fluidity, which can be problematic for companies with existing tools.

Target audience:

Axonaut particularly targets micro-enterprises, SMEs, startups, and entrepreneurs looking for a centralized solution to manage both their cash flow, invoicing, and customer relations. It is ideal for small businesses wishing to maximize the automation of their financial processes while keeping an eye on their growth through the other modules included in the offering.

Pricing:

Prices for Axonaut start at €69 excl. tax per month for a single license, with scalable prices depending on the number of users and activated features. The software also offers a free trial allowing companies to test all functionalities before subscribing to a paid offer. Additional modules can be added based on needs for extra fees.

12. Turbopilot

Advantages:

Turbopilot stands out for its versatility and ability to automate numerous financial tasks, including cash management, invoicing, tracking receivables, and budget management. It also offers advanced features for project management, making it a robust solution for companies looking for a complete tool. Turbopilot provides automated reports and alerts to manage cash flows while being suitable for various sectors.

Disadvantages:

The interface of Turbopilot may seem complex for new users, and the learning curve is relatively long. Additionally, some advanced features may require additional fees.

Target audience:

Turbopilot is designed for growing companies, particularly those managing multiple projects and needing automated management of their financial flows. It is suited for SMEs with structured financial teams.

Pricing:

Prices for Turbopilot start at €39 per month, with additional options depending on project management needs and company size.

13. Sage

Advantages:

Sage is a well-established player in the field of financial management software, and its cash management module is comprehensive if you consider the various options. It offers a suite of features ranging from accounting to payroll management, including invoicing and cash flow forecasting. Its market-leading position makes it a reliable and robust solution, particularly appreciated by large companies for its easy integration with other ERP (Enterprise Resource Planning) software.

Disadvantages:

Sage is a powerful solution primarily intended for large groups. It has since evolved for smaller businesses (Sage 50). However, some clients have expressed dissatisfaction regarding performance issues, especially concerning charges that continue despite cancellation. Moreover, the interface lacks modernity.

Target audience:

Sage targets mainly large enterprises and ETIs (intermediate-sized enterprises) that have advanced needs in financial management, cash flow, and accounting. It is also well-suited for companies seeking an integrated solution within an ERP framework. However, options also exist for SMEs and micro-enterprises.

Pricing:

Prices for Sage vary according to modules and the company's size, but they generally start around €50 per month for micro-enterprises, with additional costs for specific functionalities.

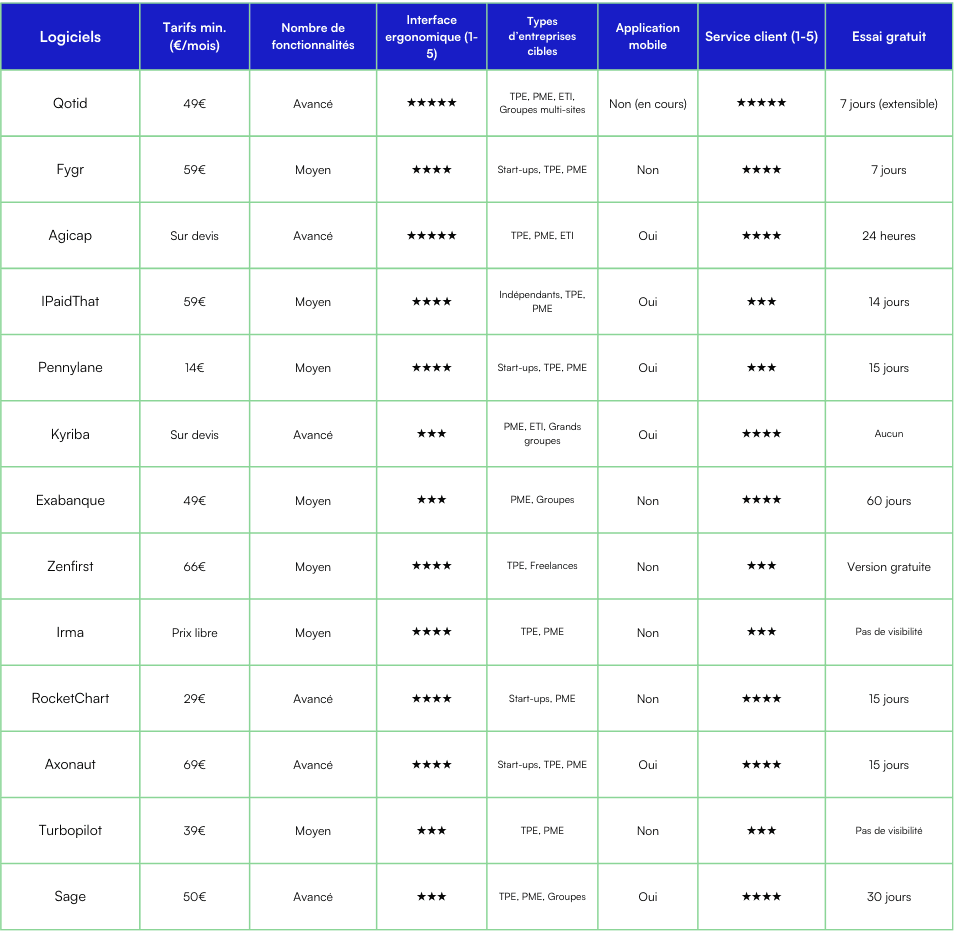

Comparative table of the best software according to your company's needs:

Who are cash management software intended for?

The cash management software are essential tools for a wide range of professionals specializing in financial management.

But who exactly are they intended for?

Business leaders

They need precise control over their finances to ensure the sustainability of their company. These software tools allow for a detailed analysis of expenses, cash inflows, and outflows, providing a comprehensive view of cash flows. This enables leaders to anticipate liquidity needs, plan investments, and ensure optimal financial management.

Financial directors (CFOs)

These professionals are among the key users of these solutions. Their roles involve continuous monitoring of expenses, developing budgets, and automating billing processes.

Management controllers

For management controllers, these tools are essential for analyzing the discrepancies between forecasts and actual results, as well as optimizing costs and improving the company’s margins.

Treasurers

They also benefit from these software tools to manage liquidity flows, ensure payments are made on time and that company funds are used effectively. By monitoring transactions, they can anticipate cash deficits or surpluses and adjust strategies accordingly.

Risk managers

They use these tools to assess and anticipate risks related to liquidity management, interest rates, or currency fluctuations. By integrating these software, they can better manage financial uncertainties and develop strategies to minimize negative impacts on the company's finances.

Financial analysts or auditors

They find in these software efficient means to deeply examine financial performance, track key indicators, and ensure transparency in financial reports. Auditors can ensure that internal processes comply with standards and that financial statements reflect reality, while financial analysts provide strategic recommendations for improving profitability.

Most of the tools we have mentioned were designed to meet the needs of financial experts, although some solutions do not require very advanced knowledge — this of course depends on the size of your company and its current needs.

Why invest in paid software?

In its lifetime, a company may find itself in surplus or in need of cash.

When the company is in surplus, it has available funds that exceed its immediate needs. This situation offers opportunities for investment or savings, but it also requires rigorous management to avoid leaving unused capital.

Conversely, when faced with a liquidity shortfall, the situation becomes much more critical. This means that the company does not have enough liquidity to cover its essential disbursements, such as paying suppliers, paying salaries, or repaying debts. These moments of financial strain can quickly jeopardize the company's balance, even its sustainability.

In the face of such challenges, it is essential to be able to understand and anticipate these fluctuations. This is where financial analyses come into play, made possible by financial management software. These tools provide valuable help to companies by offering a simplified and clear view of their financial situation.

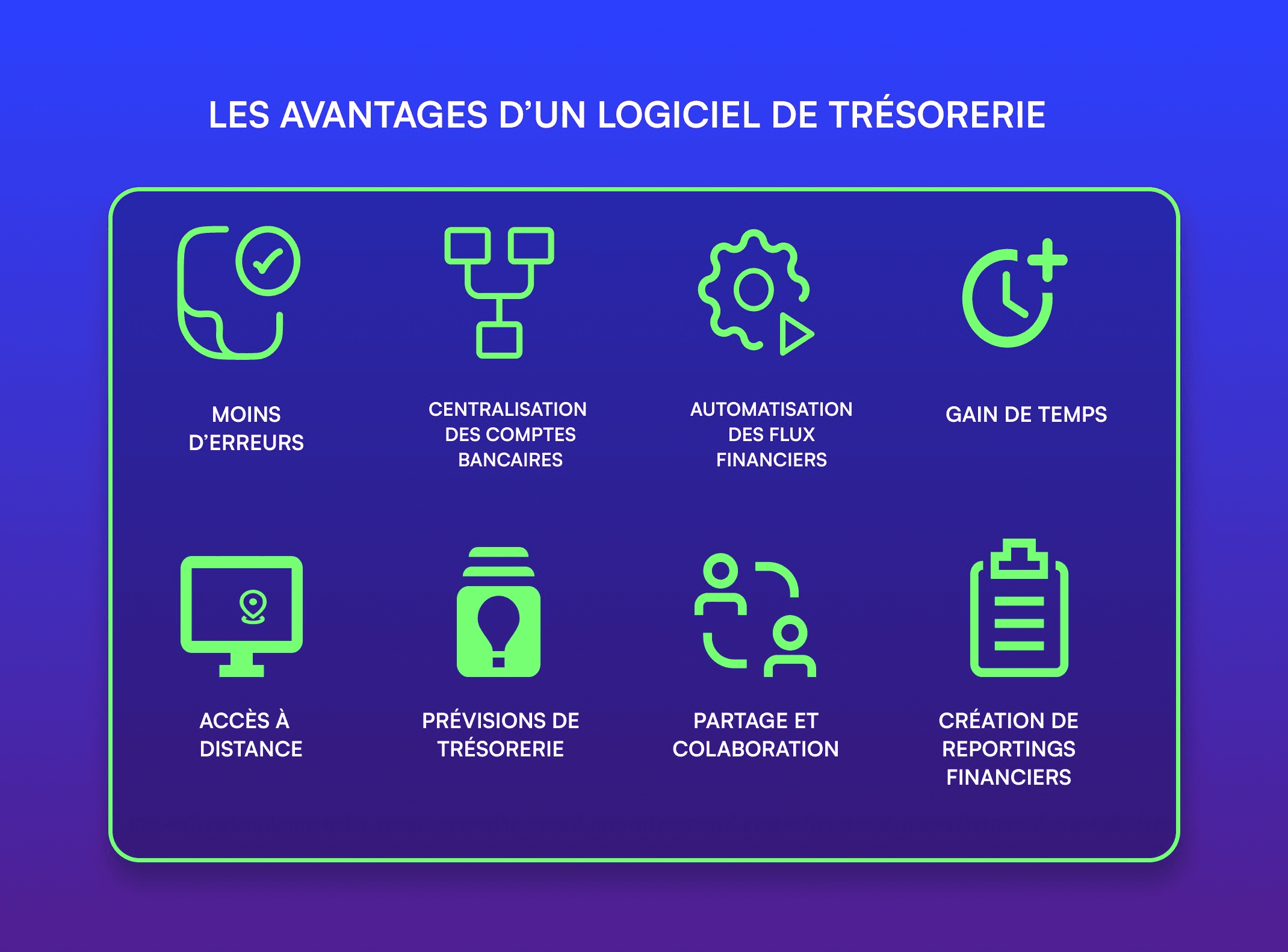

The tangible advantages of cash flow software

To better understand the complex situations of managing financial flows, these software provide a series of advantages that improve decision-making and daily management. Here are the key benefits:

The advantages of cash flow software

Automation of financial flows: Software allows for the automation of recurring tasks such as payment entries, managing bank transactions, and following receivables. This significantly reduces the risk of human error while easing the workload.

Significant time savings: Thanks to automation, financial teams spend less time on time-consuming administrative tasks and can focus on analysis and strategic decision-making.

Reduced errors: By eliminating manual data entry, specialized software decreases the risk of accounting errors or discrepancies in cash flows. This ensures greater reliability of financial data.

Centralization of bank accounts: By directly connecting the software to the company's bank accounts, all transactions are centralized in one place. This facilitates tracking of cash flows and provides an overview of liquidity at any time.

Cash flow forecasting: Software offers tools for mid and long-term cash forecasting, allowing companies to anticipate future fluctuations and better prepare for periods of surplus or liquidity shortages.

Creation of financial reports: This software generates clear and visual reports, providing an accurate picture of the company's current financial situation. These reports facilitate discussions between leaders, accountants, and other stakeholders.

Sharing and collaboration: Reports can be easily shared with leaders, accountants, or anyone who wishes to monitor the company's cash flow. This promotes smoother collaboration and more informed decision-making.

Remote access: Finally, one of the major advantages is the ability to access the company’s financial data anywhere, at any time, thanks to online platforms. This allows leaders and financial teams to follow the cash flow, even while on the move.

These software are not just practical tools; they have become indispensable allies in ensuring smooth and accurate management of financial flows.

In situations of cash shortage or surplus, they allow for anticipation, quick reactions, and informed choices to maintain the company’s financial stability. By simplifying daily management, optimizing forecasts, and reducing errors, these solutions help companies stay on course despite financial uncertainties. For leaders, it is an additional guarantee to be able to calmly steer the performance of their company.

How to choose the right cash flow software?

For companies, this investment deserves consideration. It is therefore important to know all the criteria to take into account when choosing the software perfectly suited to its activity.

The number of connected banks

Ensure in advance that the software can connect to your bank (or your banks, if you have several).

This guarantees business leaders that the software will be able to retrieve all financial information from 1 or more banks and analyze a maximum of data.

Ease of use

The software should be user-friendly. One of the main interests of cash flow software is to save time. If the software is too complex and leaders spend a considerable amount of time understanding how it works, it becomes a hindrance to the company’s activity growth.

Subscription price

Compare the prices of different cash flow software.

The hidden costs related to the tool

Some cash flow software have, in addition to the standard subscription price, other fees that add to the client's burden for training, maintenance, integrations, etc. It is essential to take these elements into account when selecting the cash flow software you wish to use.

Features

Bank aggregation

All the company's bank accounts have the possibility of connecting to the cash flow software. This is a major advantage, meaning that the company will benefit from centralized access to all its financial information, thereby improving its operational efficiency.

Cash flow tracking

Given that the cash flow software is connected to various banks, users can monitor real-time cash flow movements.

Creation of reports (cash flow table)

The cash flow software simplifies report creation. By considering all the centralized financial information on the software, cash flow software can highlight the most important key indicators of the company and create tables and graphs. These reports are understandable and shareable and are, on most cash flow software, customizable and collaborative, which fosters communication between teams.

Cash flow forecasts

Some cash flow software feature advanced forecasting functionalities, allowing companies to anticipate their future cash flow needs. These forecasts are based on analytical models, thus giving companies a head start in their financial planning. These functionalities are particularly relevant for forecasting future hires, renewing equipment, etc.

Additionally, creating forecast scenarios is ideal for comparing actual and projected cash flows. Analyzing the differing amounts allows for visualizing the impact of certain expenditures on the company’s financial situation. The ultimate goal is to help them make informed decisions while avoiding potential crisis situations.

Categorization of flows

This is an essential functionality in cash flow software. The categorization of flows allows for the automatic categorization of different financial information, providing a clear and structured view of the various banking movements (customer invoices, loans, payments, subsidies, etc.).

The adaptability of the software

It is important to check that the software is scalable if the company's activity expands (notably at the level of the number of bank connections or the number of transactions).

The support and available resources

Sometimes cash flow software can be complex to use. For this reason, it is useful to check, before committing, the responsiveness of customer support and the resources made available to users if they encounter problems.

The security of data

Cash flow software is directly connected to your banks and thus has access to your banking information. It is essential to verify that these software comply with current laws and regulations, and specifically to check for the presence of an SSL certificate when connecting.

Alternatives for managing business cash flow

To optimize their cash management, professionals have various options outside of dedicated software. An economical alternative is to create an Excel spreadsheet by oneself, but this requires time, diligence in tracking accounts, and mastery of accounting formulas and concepts.

A more expensive solution than using Excel or cash flow software is to appoint a treasurer. This expert professional can ensure precise tracking of financial flows, control accounts, develop forecasts, and anticipate potential problems. Although effective, this option is often preferred by large companies due to its high cost.

Regardless of the solution you wish to favor based on your specific needs, budget, etc., the most important thing is to keep a close eye (and even both) on your cash flow to avoid bad surprises or even bankruptcy.

The best option remains, of course, the use of cash flow tracking software.

F.A.Q:

1. What is cash flow software?

Cash flow software is a tool designed to help leaders optimize the financial management of their company. It enables real-time liquidity tracking, the creation of scenarios to anticipate future cash flow, and simplifies the financial management process by connecting to the company's banks.

2. Who can use cash flow software?

Cash flow tracking software is primarily intended for leaders of micro and small enterprises (TPE/SME), finance professionals, accountants, company treasurers, and anyone involved in managing a company's financial flows.

3. Why invest in cash flow software?

Cash flow software provides a simplified view of the various financial situations of a company, automates financial management flows, reduces errors related to manual data entry, allows connection to bank accounts, offers mid and long-term cash forecasting, and facilitates the creation of reports.

Also read: The 7 best automated reporting software

4. How do I know if I need cash flow software?

It is certainly more relevant to look for cash flow software if you are a leader or an employee (accountant, treasurer, management controller) within a company. That said, high-potential entrepreneurs might already question the acquisition of such a solution, even contacting a salesperson for a demo. During this demo, you will see in real-time how your invoices are managed and learn more about the overall expense management process.

5. Can we do without a financial expert?

Cash flow software does not completely replace a real professional, but it can greatly facilitate and optimize the work of finance professionals. Cash flow software offers significant advantages, particularly the automation of repetitive tasks such as transaction entry, bank reconciliation, and report generation, allowing for time savings and reducing human errors.

However, they present significant limitations.

For example, they cannot replace human judgment, nor guarantee that all legal requirements are met, which is crucial for compliance and regulation.

Additionally, the financial needs of each company are unique, and a finance professional can tailor their services to meet the specific needs of the business, whereas software can be more rigid.

Ultimately, both can and should work together to offer optimized financial management, combining the automation of expense management and data analysis with human expertise to minimize risks and maximize performance.