The links between financial consolidation and reporting

lucas-fontaine

•

Jul 8, 2024

The effective management of corporate finance and informed decision-making necessarily involves the analysis of performance indicators (KPI). However, it is impossible to analyze these indicators if the data is not reliable and/or is scattered among different sources. For some companies and multi-establishment groups, this may mean the need to consolidate their financial accounts to obtain a clear overall view of their financial situation.

This is where the concept of financial consolidation comes into play. But what exactly is financial consolidation? How do consolidated accounts work? And how can financial data consolidation improve reporting?

In this article, we will explore these questions and show how a SaaS solution for corporate finance management can optimize reporting production through data consolidation. So, whether you are simply looking to understand what financial consolidation is or wish to better grasp the links between consolidated accounts and financial data analysis, this article is for you.

What is financial consolidation?

Financial consolidation is an essential process that allows for the grouping and synthesis of financial information in order to provide a company or group with an overall view of its financial situation.

The consolidated data can therefore come from different departments within the same company or from different entities of a multi-establishment group. The financial consolidation of multiple subsidiaries is generally more complex than consolidating the accounts of a single company.

What is a consolidated account?

The consolidation of accounts is a common practice in groups with multiple subsidiaries or entities. It simplifies financial management and facilitates strategic decision-making.

A consolidated account integrates the assets, liabilities, income, and expenses of all the establishments that make up the group.

The consolidation of accounts is achieved by following specific consolidation methods that you can find in this article from compta-facile.com.

These consolidation methods aim to eliminate double counting and to faithfully reflect the economic reality of the group. For example, internal transactions within the group are eliminated to avoid distorting the overall result.

The more a company grows, the more complex the task of account consolidation becomes, requiring specific skills in accounting and finance. This is why many companies turn to specialized solutions to ensure the reliability of their consolidated accounts.

Financial data consolidation and reporting?

Financial data consolidation and financial reporting are two closely linked processes in that the previously consolidated data is generally intended to be analyzed afterwards. The goal is to enable companies to make better strategic decisions based on reliable data.

Reporting can be viewed as the process of communicating this consolidated information to the various stakeholders of the company (internal or external), whether they are executives, shareholders, employees, etc.

Financial reporting can take various forms, from a simple Excel spreadsheet to dashboards and other customizable charts, depending on the tool chosen by the company.

The financial consolidation and financial reporting are closely linked. Without effective financial data consolidation, reporting would be incomplete and potentially misleading. Conversely, without reliable and clear reporting, the consolidated information would not be utilized to its full potential.

However, financial data consolidation and reporting can be complex and time-consuming processes, particularly for companies with multiple entities or establishments. This is where solutions like Qotid come into play.

How does Qotid optimize financial consolidation?

Qotid is a SaaS solution for corporate finance management (financial BI) that helps small and medium enterprises (SMEs) and multi-establishment groups to steer their performance and have a clear view of their profitability.

Qotid retrieves both accounting data from the company's accounting tool and commercial data from business software (PMS, POS, etc.)

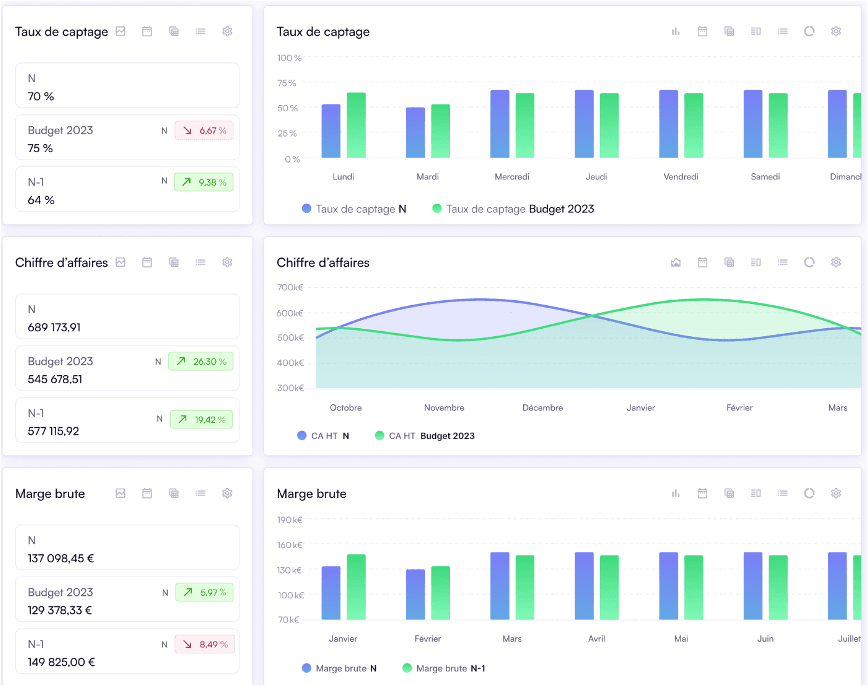

Thus, companies with multiple entities can directly create consolidation groups via Qotid, enabling them to visualize and analyze all their financial data in the form of dashboards, charts, and income statements, either for each subsidiary or in a consolidated view at the group level.

In general, reporting automation solutions are becoming almost essential for any business whose activity is starting to develop. The volume of data can quickly become too large to be managed manually and without human errors.

Qotid offers advanced reporting features, allowing for the production of consolidated and customizable reports.

In summary, the benefits of a financial management and reporting production solution will rely on the consolidated data upstream to allow the company:

a boost in productivity,

a time savings,

to generate reliable financial forecasts at the level of one or more establishments.

In conclusion, financial consolidation is an essential practice for any company, especially multi-establishment groups. It allows for the grouping and analysis of financial data from across the enterprise to obtain a clear and accurate overview of its financial health.

Today, every strategic decision must be based on data. This is why there are many tools dedicated to data consolidation, reporting and budget automation, or even invoice and cash management, that enable executives to have a clear view of their profitability in real-time through reliable and centralized data.