The non-financial reporting: the example of a CSR approach

Amber Baynaud

•

Jul 8, 2024

The evolution of societal expectations has impacted the business world, requiring companies to pay real attention to their social and environmental commitments. Today, Corporate Social Responsibility (CSR) is considered a fundamental pillar of corporate strategy.

First, these CSR initiatives allow entrepreneurs to position themselves as engaged actors, which is essential for thriving in a changing market and also for responding to the growing aspirations of their stakeholders.

Furthermore, while company reports have long favored financial data to attract investors or shareholders, it is now recognized that a company's activity is not limited to its economic impact. It also generates significant social and environmental repercussions. Thus, the push towards the publication of non-financial information has gradually emerged at national, European, and international levels.

In France, we refer to the “extra-financial performance statement” (EPF).

What is extra-financial reporting?

Extra-financial reporting is the communication of non-financial information by a company. It takes the form of a report highlighting the company's performances in social, environmental, and societal domains. Discover in the rest of this article all you need to know about extra-financial reports.

Distinction between financial reporting and extra-financial reporting

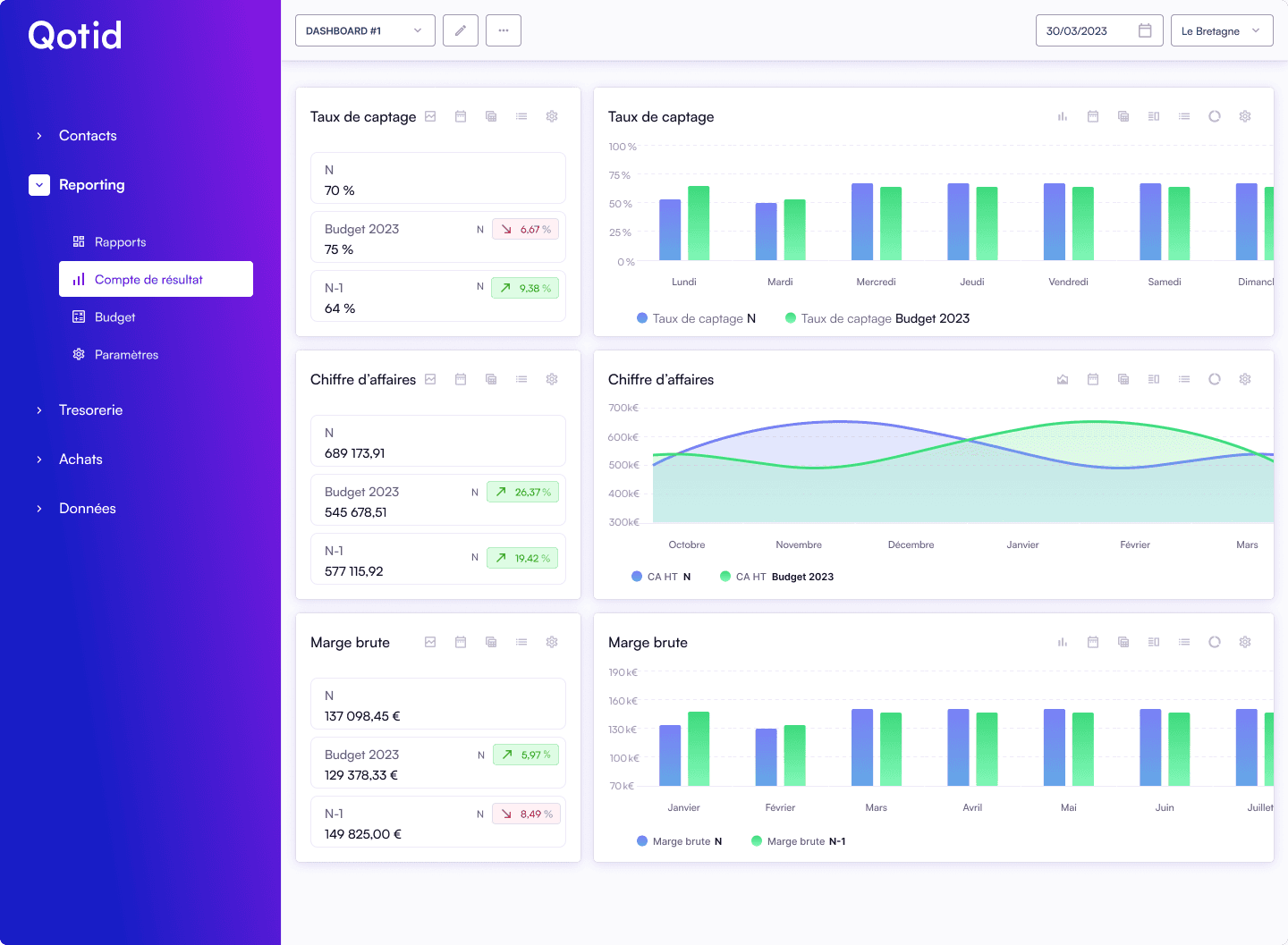

First, we have financial reporting, which primarily focuses on financial data such as profits, losses, revenues, etc. It is an essential report for investors or shareholders.

Financial reports, although solely dedicated to the company's numeric data, are not easy to establish. These tasks can be time-consuming or repetitive. This is why there are tools that allow the automation of these reports, such as Qotid, aimed at helping companies make better decisions.

In parallel, we have extra-financial reporting. According to the Ministry of Ecological Transition and Territorial Cohesion, it entails “communicating about the social, environmental, and societal implications of its activities as well as its governance mode.” The objective of an extra-financial report is to account for non-financial data of an activity. Its interest therefore exceeds the monetary dimension to encompass social, environmental, and governance (ESG) aspects.

Extra-financial reporting aims to provide an overview of a company's performances, going beyond its simple financial results.

Which companies are affected by extra-financial reports?

As a general rule, companies of all sizes can be subject to extra-financial reports. However, these reports are particularly relevant for large publicly traded companies, for companies operating in sectors with high environmental or social impact, as well as for those wishing to demonstrate their commitment to sustainability and social responsibility.

The companies required to draft an extra-financial report are therefore:

Public companies with a total balance sheet of 20 million euros or a net turnover of 40 million euros,

Private companies with a balance sheet or turnover of 100 million euros,

Companies with more than 500 permanent employees.

What are the differences between extra-financial reporting and CSR reporting?

There are many names for documents encompassing the environmental practices of companies.

But what are their differences? How to wisely use these terms?

CSR reporting is an official periodic document published by companies to communicate about the company's activities regarding social responsibility. It is drafted voluntarily by the companies.

It allows for a better assessment of the consequences of their activities on the economic ecosystem, the environment, or society.

The extra-financial reporting is the generic name given to the report made by companies on their non-financial data, whether at the European or national level, as we have explained.

In France, this document, obligatory for certain companies, is called the “Extra-Financial Performance Statement” (EPF). This report must be drafted annually, at the end of the accounting period, and communicated 15 days before the General Assembly.

The major difference between CSR reporting and extra-financial reporting mainly lies in the content. CSR reporting is a document resulting from a voluntary initiative by companies. The objective is to allow companies to identify their priority issues to demonstrate their overall and voluntary commitment to sustainability and social responsibility. In contrast, the EPF consists of the annual publication of non-financial information related to their environmental, social, and societal impacts, typically presented as a list of indicators.

What are the themes of an extra-financial report?

The themes addressed in an extra-financial report aim to provide a complete picture of the company's commitments in terms of sustainability and social responsibility.

We distinguish 3 main themes:

Social: employment, work organization, health and safety, equal opportunities, social relations, employee distribution, working conditions, etc.

Environmental: overall policy, waste management, circular economy, sustainable alternatives implemented, etc.

Societal: commitment to sustainable development, fairness of practices, relations with stakeholders, environmental issues considered in purchasing and selling policies, territorial impact, etc.

What should be included in an extra-financial report?

The extra-financial report must contain several essential notions. You can find all the points on which the content of the EPF now focuses in Article 225-105 of the Commercial Code. Here are the important points:

Presentation of a business model: the aim is to explore the various sources of value and explain the fundamental reasons that ensure the sustainability of the company's activity (its business environment, organization, structure, market, objectives, value creation strategies, etc.)

A description of each category of information (social, societal, environmental) incorporating the following steps:

A description of the main risks related to the company's activity in terms of CSR.

A description of the policies applied to prevent, identify, and mitigate the occurrence of these risks.

The key performance indicators to evaluate the results of the policies implemented and validate or not the achievement of the various objectives.

A clear and concise explanation justifying the risks related to the mentioned activity.

What is the interest for SMEs to consider CSR initiatives?

Today, many SMEs are implementing CSR initiatives, although they are not legally mandatory. Many entrepreneurs establish CSR measures out of conviction. But what are their motivations?

An SME that wishes to sustainably establish itself in a market cannot neglect the social, environmental, and societal aspects of its activity. This is why they have a real interest in caring about these initiatives. Here are some reasons:

Its transparency: ensuring transparency in the company's operations, particularly towards its stakeholders, is essential. The company thus demonstrates its commitment to sustainability, responsibility, and ethics. This transparency strengthens trust and credibility among stakeholders such as investors, customers, employees, and society as a whole, while allowing for concrete strategic management and a more accurate assessment of the overall impact of the company.

Its brand image: adopting responsible practices could enhance the company's reputation among consumers. This could lead to new customers or loyalty from existing customers.

A reduction of risks: some conflicts may arise from a failure to comply with regulations within the company. By integrating sustainable practices, reputational crises or supply chain disruptions could be impacted.

Its innovation: CSR initiatives often lead to new ways of thinking, new ways of acting, or new more sustainable manufacturing processes.

Increased capital: investors and shareholders are increasingly attentive to ESG (Environmental, Social, Governance) criteria and thus favor their investments in companies with responsible practices.

Thus, CSR initiatives offer significant competitive advantages, creating lasting value for companies. Although not mandatory, companies have every interest in engaging in sustainable and responsible practices. This is why these initiatives are increasingly integrated into SMEs to meet societal expectations and position themselves as engaged actors capable of navigating a changing market.

The extra-financial reporting is an example of a CSR initiative for companies. A mandatory document for certain companies, it allows them to enrich their reports with numerous data related to their activity. This data consists of non-financial information and will focus on environmental, societal, and social aspects.

F.A.Q Extra-financial Reporting:

How to make the Extra-financial reporting?

First, it is necessary to determine the key performance indicators for CSR that will allow measuring progress in this area. Then, it is necessary to collect and analyze this data, which could come from internal reports, audits, etc.

These first two steps allow for the proper development of the extra-financial reporting.

It includes mandatory information such as:

- The presentation of a business model

- A description of CSR risks

- The policies applied in response to these risks

- The results of these policies in the form of performance indicators

Finally, as with any type of reporting, the extra-financial reporting must be presented clearly and concisely to all stakeholders, usually once a year.

What is an Extra-financial indicator?

We talk about ESG (Environmental, Social, and Governance) indicators to describe the criteria that allow evaluating a company's performance outside of the usual financial criteria.

These could include energy consumption, waste management (Environmental) or staff turnover rates, workplace safety (Social), or the composition of the board of directors and transparency regarding executive compensation (Governance).

Who is affected by Extra-financial reporting?

Public limited companies are the main companies affected. In general, extra-financial reporting is mandatory for any listed company with 500 employees generating more than 40 million euros in turnover, as well as for unlisted companies with 500 employees generating more than 100 million euros in turnover.