Cash flow plan, financing plan, and cash budget: Differences

lucas-fontaine

•

Jul 8, 2024

Any business that wishes to thrive must ensure a rigorous management of its finances. For this, various tools and methods are used by companies. Among them, we find especially the cash flow forecast (or cash flow forecast), the financing plan, and the cash budget. It is not necessarily easy to navigate these concepts as they are so similar.

What are these tools actually used for? How to use them in the business world? How are they different yet also complementary?

This is what we will explore in this article.

What is a cash flow forecast?

Before delving into the heart of the matter, it seems important to clarify that the cash flow forecast is part of a set of financial forecast tables:

The projected income statement,

The projected balance sheet,

The financing plan,

The projected cash flow forecast.

As you will have understood, in this article and for the sake of clarity, we will focus on the distinctions between two of these four tables: cash flow forecast and financing plan.

Projected cash flow forecast: definition

The projected cash flow forecast, also called “cash flow table”, is a tool that allows a company to anticipate its incoming and outgoing cash flow.

More specifically, it provides a detailed view of these flows over a given period (generally one month) and visualizes whether the company collects more money than it spends.

Why create a cash flow forecast?

The main objective of the projected cash flow forecast is to anticipate future cash movements and to ensure that the company has sufficient liquidity to manage potential expenses exceeding revenues.

The short-term view of the cash flow forecast allows a company to quickly anticipate and adapt accordingly.

Moreover, the projected cash flow forecast is useful throughout the company's life cycle and particularly during its creation, a significant investment, or in the case of an intensely seasonal activity.

How to create a cash flow forecast?

First, it is necessary to comprehensively gather all the receipts and payments of the company.

The receipts include… :

The gross sales,

The capital contributions,

The current account contributions,

The financial products,

The subsidies and other public aids,

The tax refunds.

…While the payments include :

The investments,

The purchases (goods, raw materials),

The overhead costs (rent, insurance, transportation, etc.),

The salaries,

The social security contributions,

The management fees (banking, accounting, etc.),

The taxes,

The capital reductions (debt repayments).

One of the most important elements when creating a projected cash flow forecast is to always consider payment terms. Especially if you have negotiated different terms depending on your clients and your suppliers.

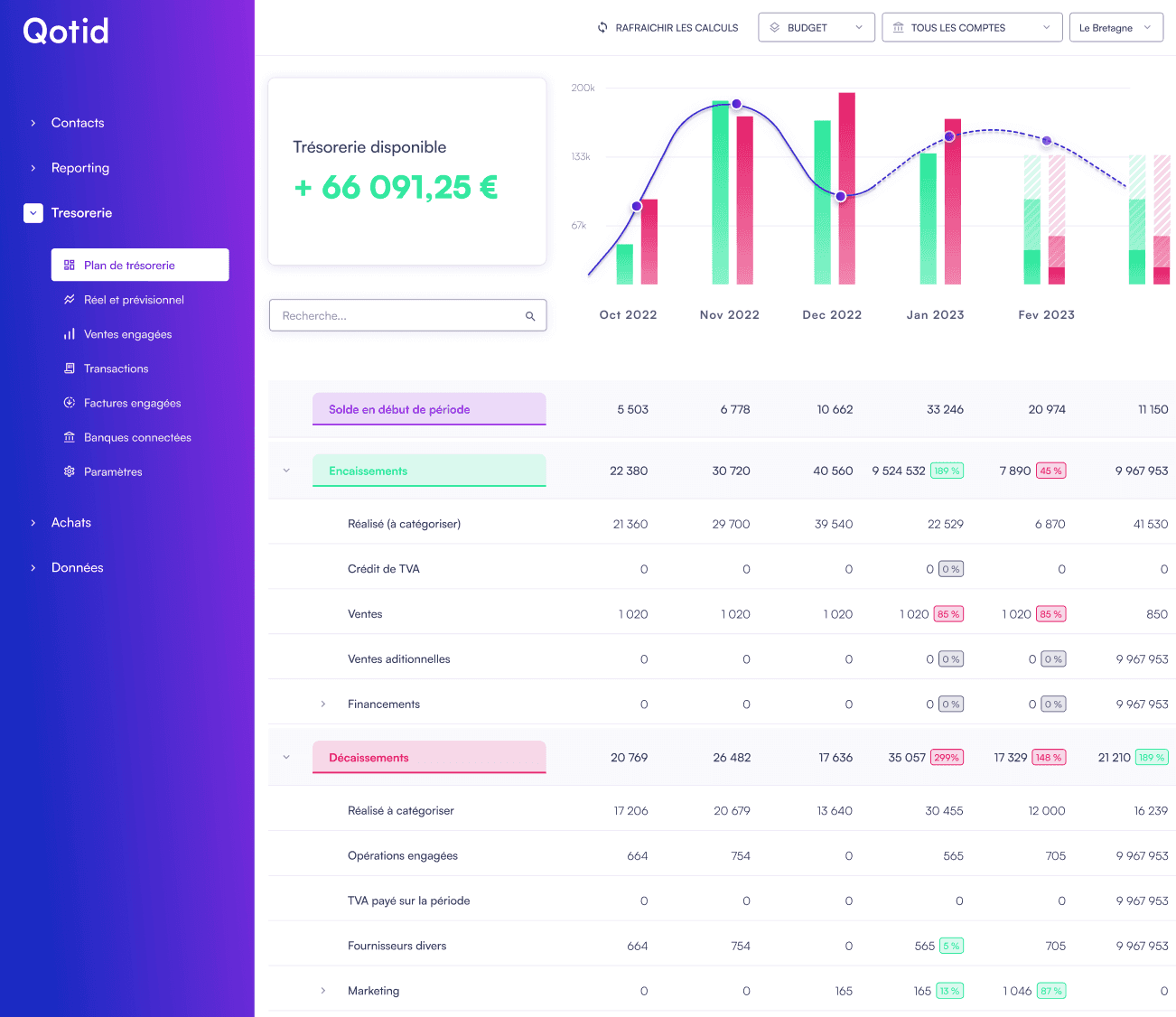

As mentioned earlier, a projected cash flow forecast can be done in the form of a table, but here is still an example of a forecast created using the cash flow management solution, Qotid.

Cash flow forecast and financing plan: differences

The projected cash flow forecast focuses on a short-term period, generally one month. At least, all receipts and payments are broken down month by month.

The financing plan, on the other hand, has a broader and longer-term dimension.

It aims to verify whether the business project is viable and whether investment projects can be supported in the first year following the establishment of the company.

It is one of the financial tables that make up the business plan and takes into account planned investments, available funding sources, as well as any debt repayments.

What is a cash budget?

If we had to summarize in one sentence, we could simply say that the cash budget is a financial element that is part of the projected cash flow forecast.

But we will go into a little more detail.

Cash budget: definition

The cash budget is based on the future. That is to say, it is used to forecast, monthly, all the predicted receipts and payments of the company. This allows determining the expected cash balances.

How to calculate the cash balance?

Because a little reminder never hurts:

Cash at the end of the month = Cash at the beginning of the month + Receipts of the month - Payments of the month

Difference between cash flow forecast and cash budget

The distinction between these two concepts lies mainly in their timing.

But we can consider the cash budget as a specific section of the cash flow forecast.

This one focuses on predicting future cash flows (up to a year), taking into account projected sales, customer receipts, supplier payments, operating expenses, debt repayments, etc.

The cash flow forecast, on the other hand, is a more comprehensive document that encompasses both the current and future cash flows of the company in the short term. It is an operational tool used for daily management and tracking of short-term cash deficits or surpluses.

How to optimize the creation of cash budgets

It is not necessarily easy to create a projected cash flow forecast. One thing is certain, monitoring your cash flow through your banking app is not enough, and creating a cash flow table in Excel is accessible but time-consuming and prone to errors (Forget to update the table, late payments not taken into account, etc.) Especially when the activity intensifies.

A cash flow table template to download

If you are starting your business and cannot help but manage your cash flow on Excel, we have crafted a cash flow table template that, we hope, will be useful to you 👇

Fortunately, there are dedicated SaaS solutions that allow you to centralize your bank flows and create reliable cash flow forecasts in a few minutes. With Qotid, you can easily forecast your receipts and payments and make better strategic decisions based on your goals.

Moreover, it is possible to effectively visualize your committed client and supplier invoices directly from your cash flow forecast.