What is a cash requirement?

lucas-fontaine

•

Jul 8, 2024

Cash flow is the financial fuel of a business. Good cash flow management is indeed necessary to support daily activities. A cash surplus (when a company generates more income than expenses) is also a sign of growth potential and good financial health.

However, all entrepreneurs, in their daily lives, face cash flow needs. And one thing is certain, the inflation and rising prices of raw materials that have hit businesses since the beginning of 2023 have not made things easier, sometimes leading to an urgent cash flow need that can be complicated to manage.

In any case, this economic context highlights the importance of cash flow in a business.

But what exactly is a cash flow need? What solutions are available to managers to address this cash flow need? Find concrete answers in this article.

What is the cash flow of a business?

The cash flow of a business corresponds to the amount of money available in its cash registers and current accounts at a given moment.

It encompasses all the liquidity needed to meet operational needs and pay current expenses such as salaries, suppliers, and debts.

It is important to note that the notion of anticipation is at the heart of cash flow management for a business. The money you have in your bank account is not representative of the actual financial health, given that the charges and expenses mentioned above must be taken into account (the balance between income and expenses) and thus reduce the liquidity actually available. This is what we call variations in the cash balance. And these can be analyzed over time using a cash flow plan (also known as cash flow forecast).

Definition of a cash flow need

In order to sustain its activity, every entrepreneur must ask themselves this question:

How much money do I need to ensure the development of my business?

The cash flow need corresponds to the amount of liquidity that the business requires to cover its charges and meet its financial obligations throughout the year, especially for customer invoice payment delays. The cash flow need is also referred to as Working Capital Requirement (WCR) and thus denotes the gap between the various cash flows (i.e., the difference between cash outflows and inflows).

More precisely, it encompasses these categories of expenses:

- Supplier payments

- Salaries and social charges

- General expenses (rent, utilities, communications, insurance, etc.)

- Debt repayments

- Purchase and storage of goods and products

- Operational expenses (transport costs, marketing expenses, etc.)

A business that experiences a cash flow urgent need or not means that it no longer has sufficient liquidity to ensure the payments we just detailed.

Origins of a cash flow need

- Payment delays 👉 Payment delays represent a real challenge for all businesses.

Moreover, delays can lengthen for customers and/or shorten for suppliers.

When you start making several payments before being able to collect the customer receivables, without having properly anticipated (thanks to a cash flow forecast), that is where problems begin.

- Stocks 👉 Poor stock optimization and inadequate control over the rotation of goods can lead to a cash flow need. This means that you have paid for your products but the receivables are slow to arrive as they are not selling as you expected. The goal is then to “minimize” the immobilization of cash flow.

- Demand fluctuations (seasonality) 👉 Low and high seasons alternate. In peak season, hiring and stock levels can drastically increase. Conversely, when activity sharply declines, current expenses must still be settled. All this can lead to an urgent cash flow need if the situation has been poorly anticipated.

- Investments 👉 Furniture, premises, IT tools, etc. Some more or less significant investments can be the source of a cash flow need if the impact of these has not been assessed in advance. Additionally, a sudden and rapid growth can create significant one-time investments also resulting in a WCR.

How to manage a business's cash flow?

As briefly mentioned when discussing cash balance or payment delays, the best way to prevent any unpleasant surprises is to create a cash flow forecast.

Usually created in the form of a table, this allows you to anticipate cash flow needs in the short and medium term. Unsurprisingly, Excel is the most common tool for creating a cash flow plan when launching a business (practicality, nearly zero costs).

On the other hand, it is not the most suitable software for having clear and instant visibility, especially when the business starts to grow. Using a spreadsheet can indeed quickly become time-consuming and a source of errors, and we advise you to surround yourself with professionals quickly.

At the very least, you can easily take advantage of a cash flow management solution that will allow you to significantly reduce your cash flow needs.

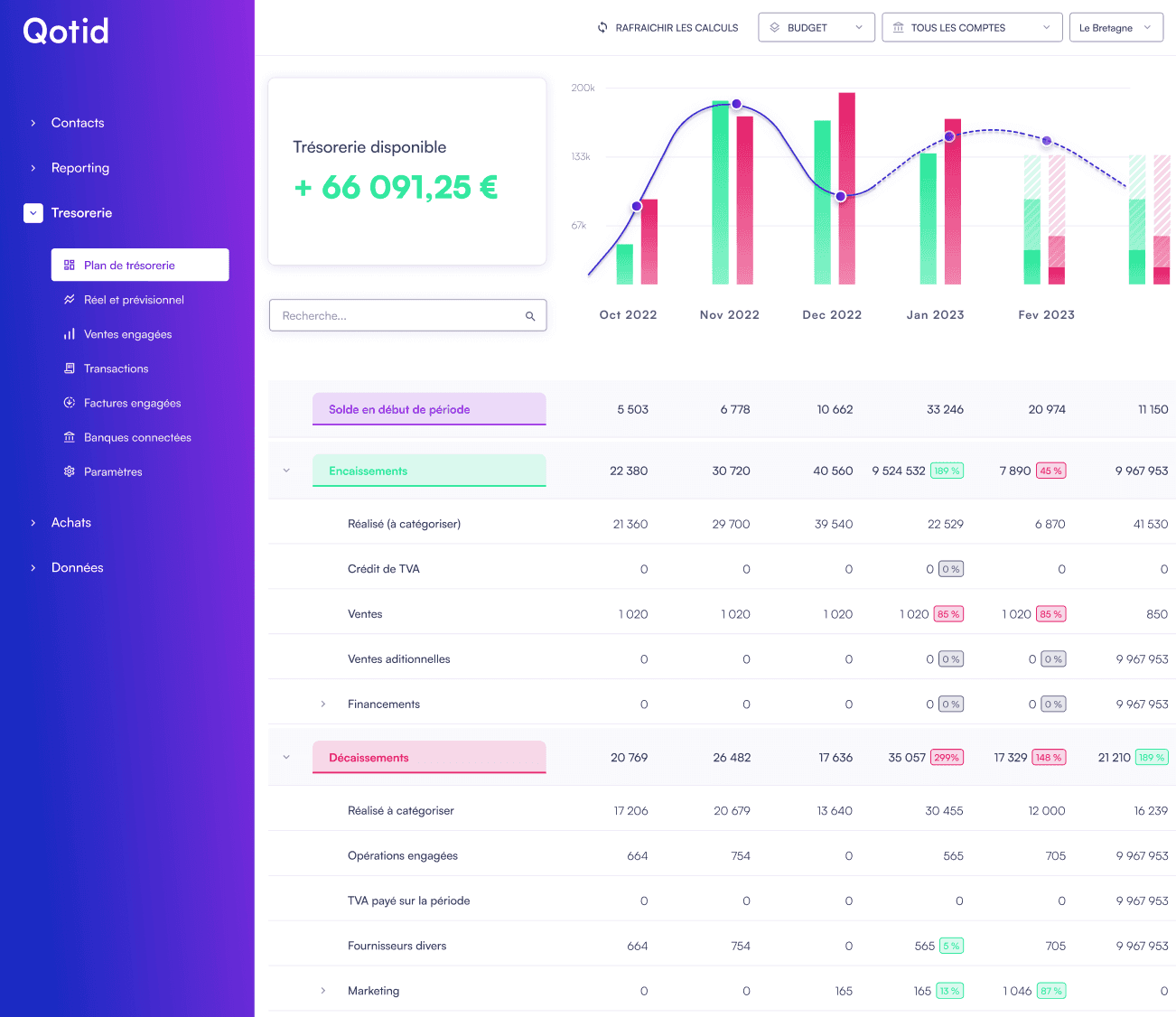

Qotid is a SaaS software for small and medium enterprises and multi-site groups that allows you to easily visualize your upcoming inflows/outflows, create budgets, and compare your actuals to your forecasts in just a few clicks.

Calculating your cash flow need

The calculation of cash flow need is done as follows:

Cash flow = working capital - Working Capital Requirement (WCR)

Thus, working capital corresponds to equity + long-term debts - fixed assets

The WCR is equal to stocks + customer receivables – supplier credits

How to finance a cash flow need?

- Factoring 👉 Involves selling customer receivables to a specialized organization called a “factor” in exchange for a commission on the amount of the invoice(s).

In practical terms, this allows the business to quickly obtain liquidity via the “factor” instead of having to wait for client payments.

The two companies are then linked by a factoring contract, and it is the factor that will handle the collection of the invoices if necessary, and not the “supplier” business.

- Trade discount 👉 Simple and effective, this practice consists of offering the client a discount on their invoice if they pay before the due date. One can consider the trade discount as the opposite of late payment penalties, allowing the business to quickly reduce its WCR.

However, be careful not to confuse this with bank discount. This practice indeed involves the intervention of a bank. The business will provide a bank with proof of receivable (commercial effect) which will in return give an advance on cash flow.

- Authorized overdraft 👉 Allows the business to be overdrawn for a maximum duration of 3 months. It should be noted that the interest rates, the authorized limit, and the processing fees can be negotiated directly with the bank.

It must be considered that additional fees are almost systematically incurred. Note that this practice is very similar to cash reserve, the only difference being that the overdraft is authorized for a shorter duration.

- Bank loan 👉 Traditional but a bit longer to set up (negotiation with the banker to see if the business can repay the loan). The bank loan allows a business, as its name implies, to borrow a certain amount of money from a bank, in exchange for a more or less high interest rate to be paid back.

In summary, the manager must ensure to assess their Working Capital Requirement (WCR) as accurately as possible, particularly with the help of a reliable cash flow forecast. The goal is to minimize the cash flow need throughout the business activity, or at least to have a negative WCR. This indicates a surplus cash flow, a sign of growth potential and good financial health for the company or group. Regardless of the source of a cash flow need, anticipation and constant monitoring are key to good financial management. By choosing appropriate financing solutions and the right tools, managers can smoothly steer their business and seize growth opportunities.

F.A.Q :

1. What is the cash flow of a business?

The cash flow of a business corresponds to the amount of money available in its cash registers and current accounts at a given moment. It encompasses all the liquidity needed to meet operational needs and pay current expenses such as salaries, suppliers, and debts.

2. What is a cash flow need?

The cash flow need corresponds to the amount of liquidity that the business requires to cover its charges and meet its financial obligations throughout the year, especially for customer invoice payment delays. It is also called Working Capital Requirement (WCR) and denotes the gap between the various cash flows (i.e., the difference between cash outflows and inflows).

3. How to finance a cash flow need?

There are several solutions to finance a cash flow need, such as factoring, trade discount, authorized overdraft, and bank loan. Factoring involves selling customer receivables to a specialized organization in exchange for a commission on the amount of the invoice(s). Trade discount consists of offering the client a discount on their invoice if they pay before the due date.

The authorized overdraft allows the business to be overdrawn for a maximum of 3 months. The bank loan allows a business to borrow a certain amount of money from a bank, in exchange for a more or less high interest rate to be paid back.

In summary:

Cash flow is a key element of a business's financial health, allowing it to meet operational needs and pay current expenses. The cash flow need corresponds to the amount of liquidity the business requires to cover its charges and meet its financial obligations.

It can be financed through various solutions such as factoring, trade discounts, authorized overdrafts, and bank loans. Good cash flow management is essential to support daily activities and ensure the sustainability of the business.